In this blog post I would like to share some insights on transfer of PCA postings to Central Finance and challenges encountered and solutions from project experience.

In SAP classic GL’s systems PCA has been an important and integral part of Finance module. Profit Center level reporting is drawn out of PCA module. Hence, having this data replicated into CFIN is quite important.

Cental Finance supports transfer of PCA documents from source system to CFIN.

What is Replicated to CFIN from PCA ledger?

In short, postings which are posted directly in PCA module are transferred to CFIN. Below business transaction types are transferred to CFIN.

- Direct PCA postings (Business Transaction Type PRC5)

- PCA Assessments (Business Transaction Type PCAA)

- PCA Distributions (Business Transaction Type PCAD)

How are these transactions posted in CFIN?

CFIN is an S/4 ERP and in S/4 ERP PCA ledger is redundant due to document splitting. So, PCA postings are replicated as FI postings in CFIN. We would go over the set-up aspects of the replication. But below are the design aspects to keep in mind.

- Postings can’t be replicated to a leading ledger.

- Postings can be replicated to an extension ledger on leading ledger or a parallel ledger.

- In my view postings to an extension ledger is a good choice as reporting on extension ledger can help reconcile CFIN with PCA subledger in source.

- If you have SAP GR on CFIN then that brings additional considerations.

Particulars of the PCA Document Transfer

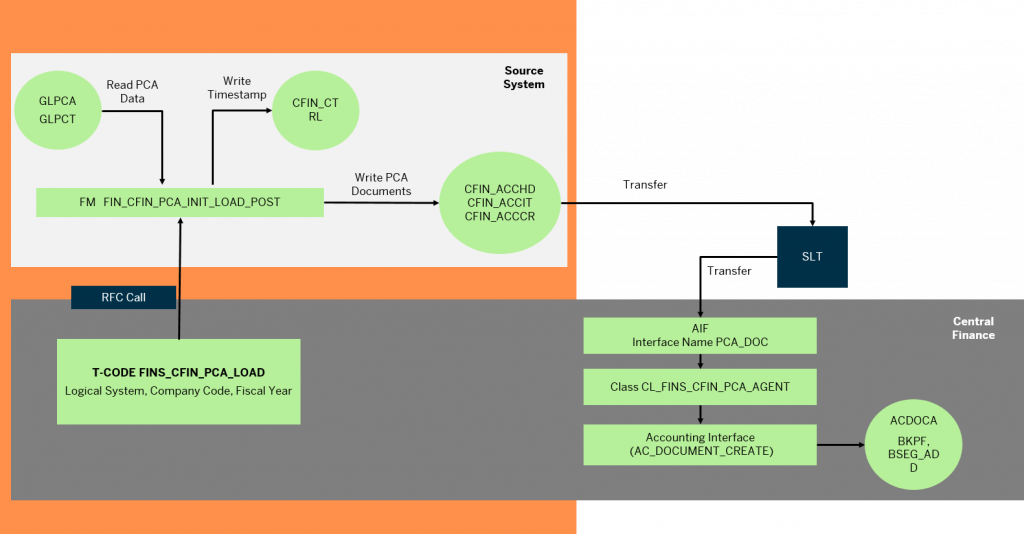

Mechanism of PCA document transfer

- PCA documents are transferred via FI staging tables into CFIN.

- Tables CFIN_ACCHD, CFIN_ACCIT and CFIN_ACCCR are used to transfer PCA documents.

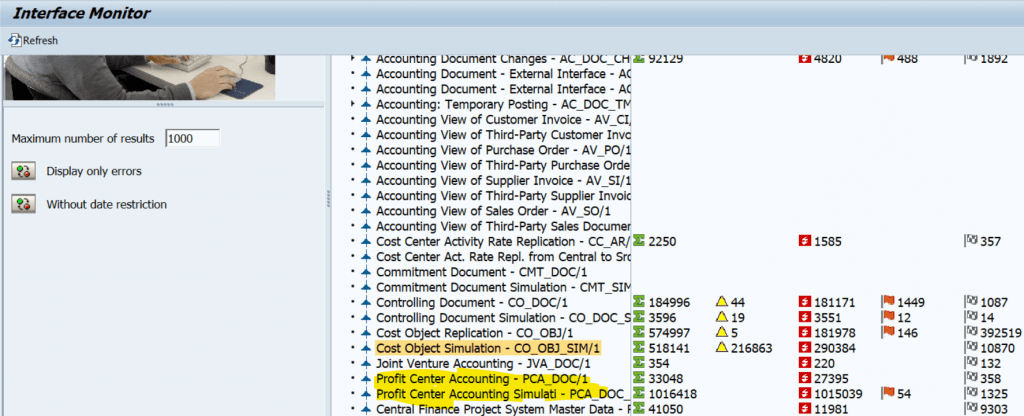

- PCA documents are replicated under a separate node in AIF.

- Documents can be transferred under replication mode and real mode.

Source System Set-up

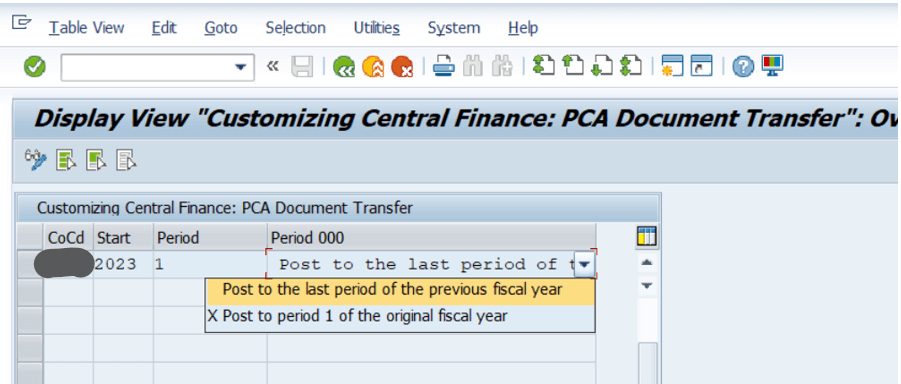

Step 1: Period Settings

Like FI documents we need to define the year and period set-up of the document transfer.

Balances are loaded before 1 Period 2023 and from Period 1 2023 actual balances are transferred.

Period 000 balances can be posted to

- The last period of the previous fiscal year (For example, balances in period 000 of 2021 are posted to the last period of 2020.)

- To period 1 of the original fiscal year (For example, balances in period 000 of 2021 are posted to period 1 of 2021.)

- By default, balances in period 000 are posted to the last period of the previous fiscal year.

- In RtR period 000 postings are not transferred to CFIN.

- Special period postings (Period 13-16) are transferred to CFIN.

- BCF run should be carried out directly in CFIN.

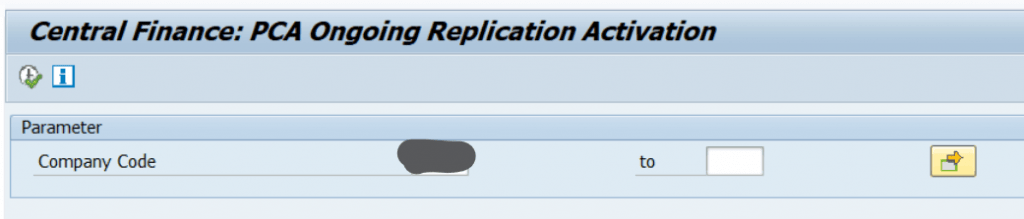

Step 2: Activating Transfer

This transaction is used to activate EC-PCA ongoing replication. Once a company code is activated for EC-PCA ongoing replication, the corresponding EC-PCA postings will be replicated from the source system to the Central Finance system automatically.

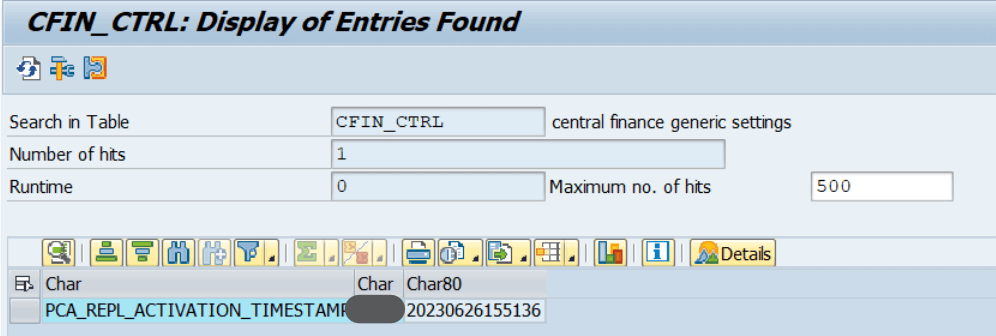

This program updates time stamp in control table CFIN_CTRL

In case you ever need to stop the recording then this control table needs to be cleaned up

CFIN Set-up

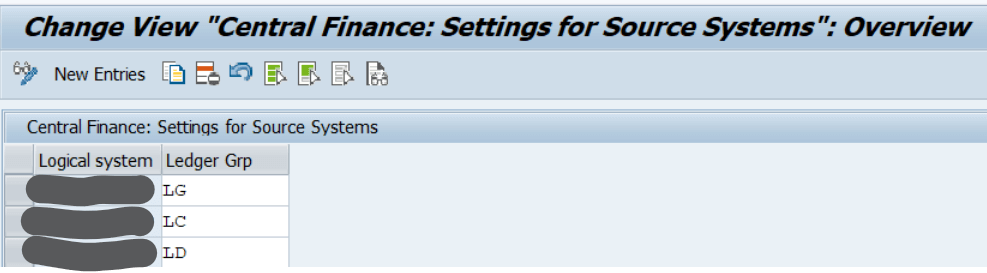

Step 1: Assignment of Ledger Group

For each of the source EPRs a ledger group is assigned. Postings are replicated to this ledger group. As written above this can’t be a leading ledger.

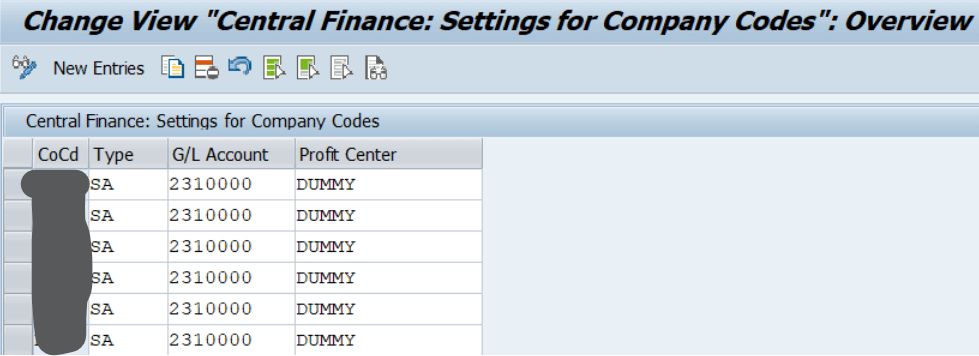

Step 2: Assignment of Offsetting Account and default PC

Here we define:

- Document Type: This is the document type assigned to the FI posting that is created from the EC-PCA posting.

- G/L Account : If a replicated EC-PCA does not balance to zero, an offsetting line item has to be created for the posting in the Central Finance system. The additional line is posted to the G/L account that you specify here.

- Profit Center: If a replicated EC-PCA does not balance to zero, an offsetting line item has to be created for the posting in the Central Finance system. The additional line is assigned to the profit center that you specify here.

Initial Load

Simulation

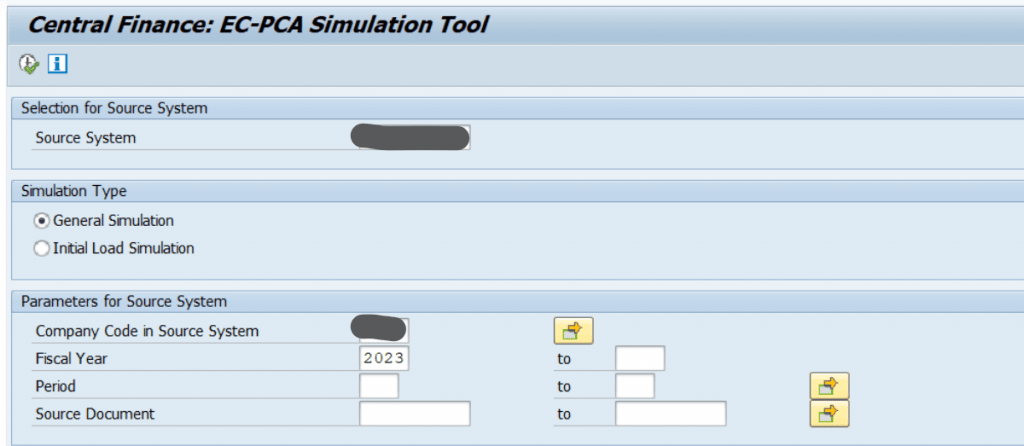

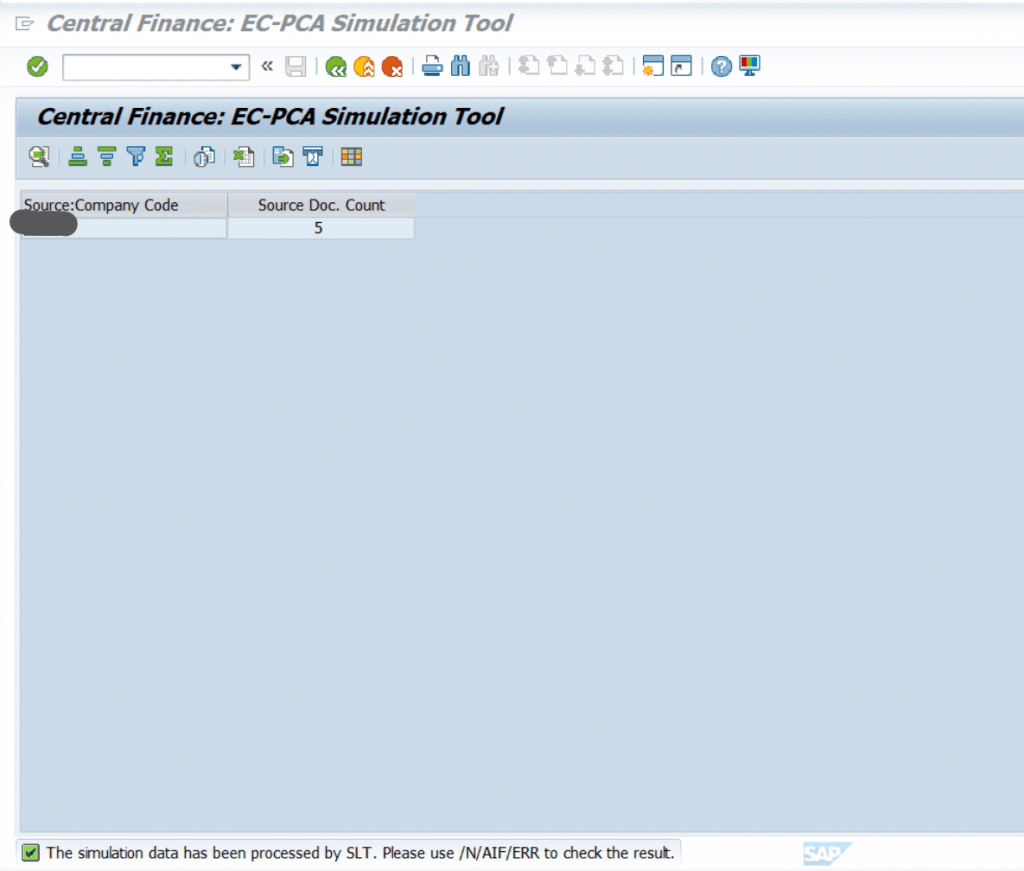

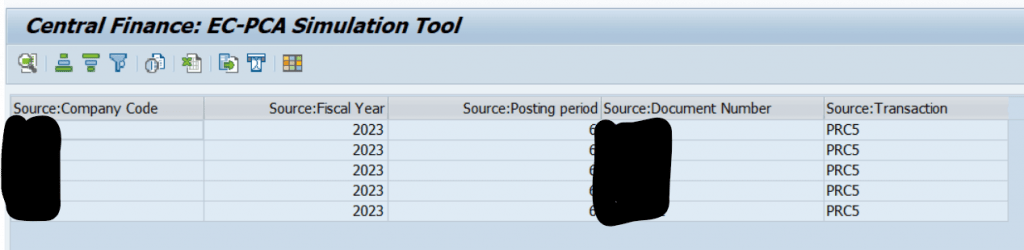

TCODE: FINS_CFIN_PCA_SIMU

- As the name suggests this transaction simulates PCA document replication. Simulation can be done by document or for IL. It shows the document numbers and balances which are selected for replication.

- Transfer happens via SLT

Actual Load

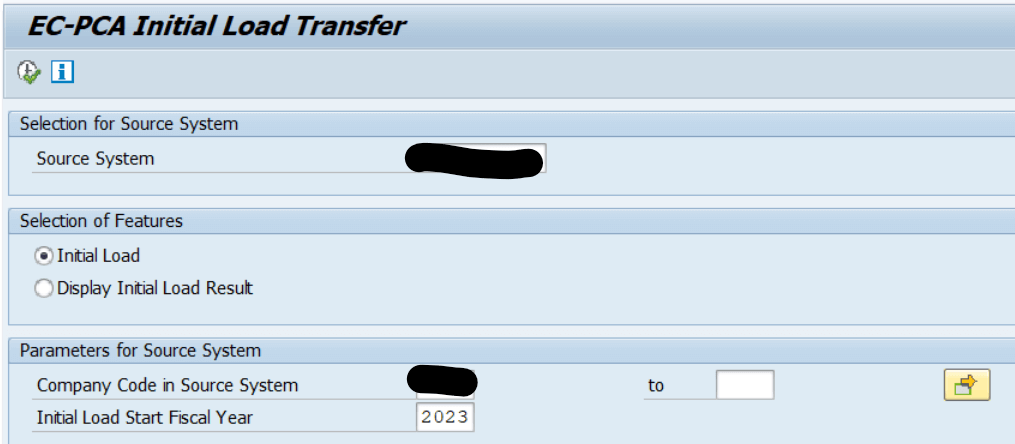

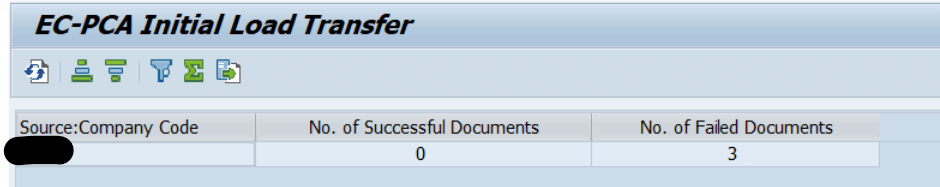

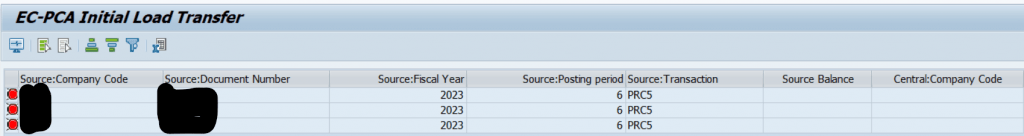

TCODE: FINS_CFIN_PCA_LOAD

- As the name suggests, this transaction carries out the initial load.

- IL can be done once for one company code.

- IL can reset and re-done.

- After running the IL results can be verified by selecting second option. System will show the document transferred and replication status of each document.

- Alternatively, documents can be reviewed in in AIF monitor too.

Real Time Replication

- Once company code is activated for replication in source. Recording in staging tables starts

- Once Real time replication is switched on from SLT. Documents are transferred on real time basis.

Reset and Deletion

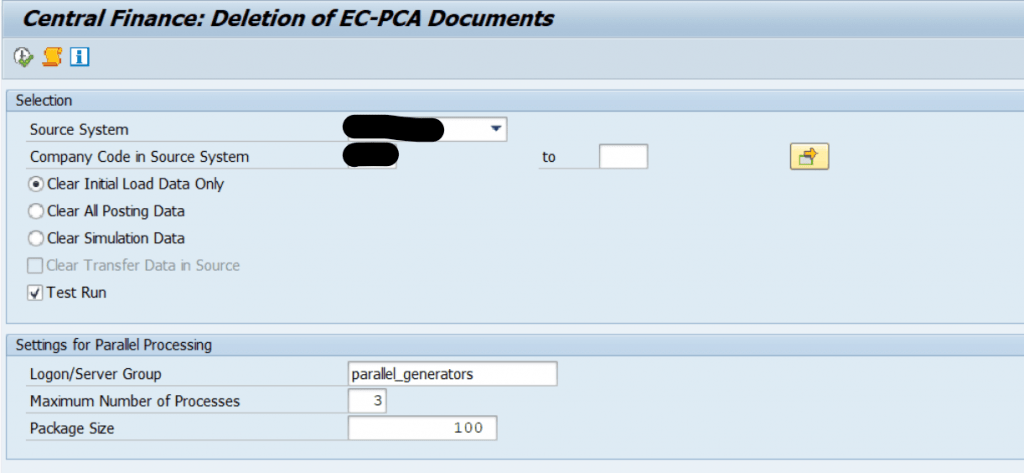

Deletion in CFIN

TCODE: FINS_CFIN_PCA_DEL

Options are pretty self-explanatory. Simulation, IL and All posting data can be deleted.

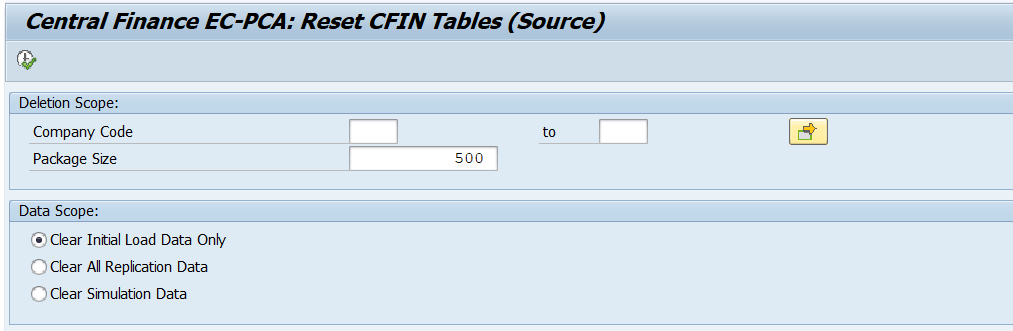

Deletion in Source

TCODE: FIN_CFIN_PCA_RESET

This transaction is run from CFIN system, and it resets PCA data from staging tables in source system. Earlier, PCA data was reset by FI deletion program RCFIN_DEL_MIG. IN 2022 SAP released note 3244253 to fix this. Now PCA data can be reset from CFIN system only using above transaction code.

Comparison Reports

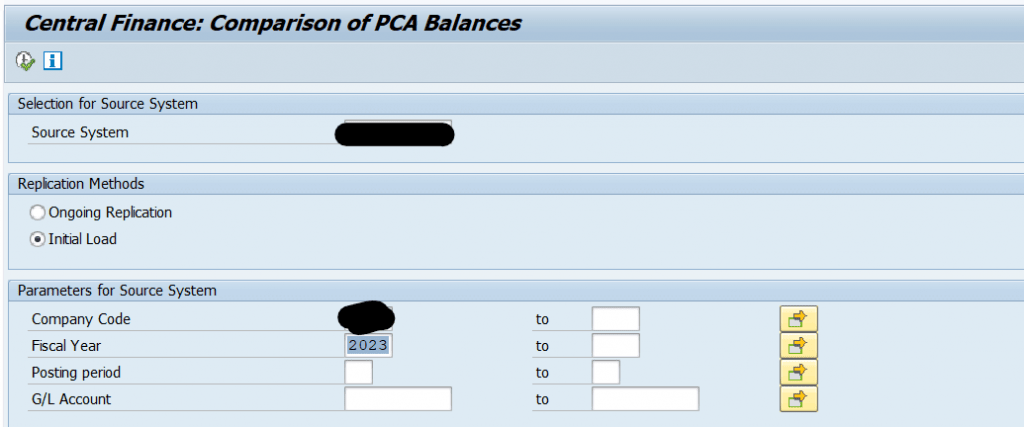

Compare Balances

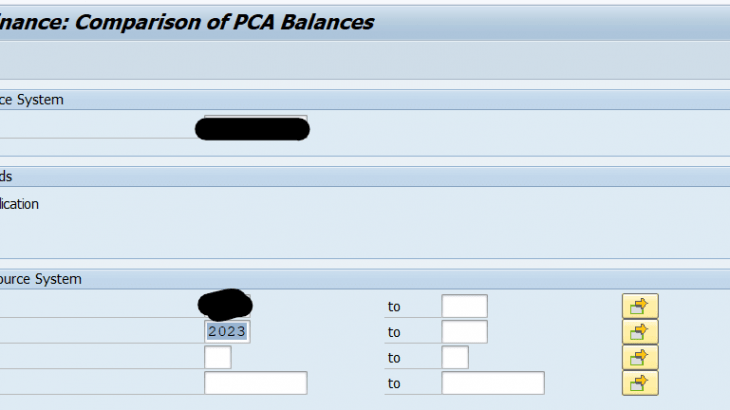

TCODE: FINS_CFIN_DFV_PCA_BA

This compares the balances of EC-PCA documents in the source system with the corresponding balances transferred to the Central Finance system and to check whether these balances have been transferred correctly.

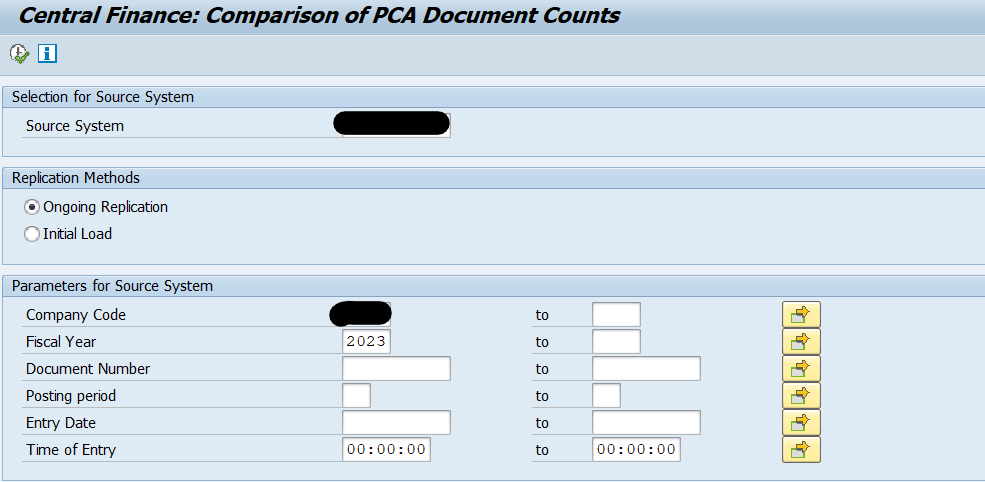

Compare PCA Document Counts

TCODE: FINS_CFIN_DFV_PCA_CN

This report compares the number of EC-PCA entries (including documents and balances) transferred to the Central Finance system and to check whether they have been transferred correctly.

Challenges Experienced

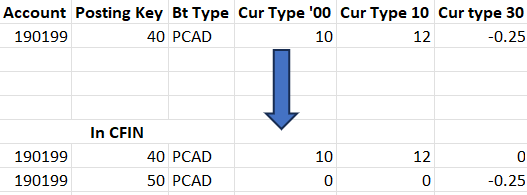

1. Positive and Negative Signage on same line

During balance transfer it could happen that a debit balance line can have a negative balance for one of the parallel currency fields or vice versa. It can happen with balances of allocations. In such situations the messages dump in CFIN. Standard SAP doesn’t support this. To overcome this such lines can be split into multiple lines in CFIN via a custom development.

2. Missing Source Account Assignment in ACDOCA

Source account assignment field is not populated with source profit center for PCA documents. This can play an important role in reconciliation. Same can be done via a small enhancement in CFIN BADI.