Fiscal Year Change

We live in a dynamic world today that is ever changing. Companies are acquiring other businesses or are being acquired. All of these acquisitions present challenges for all companies involved. One key change that frequently occurs is when the parties involved have different fiscal years. This blog will discuss a change that involves including a 13th month in the transition fiscal year. I will look at the FI side of this first and then close the blog with a look at how it impacts Fixed Assets.

In this example we have the acquired company with a 4-4-5 week cycle for it’s 12 month fiscal year. So instead of closing each period at the end of a calendar month, each period is open 4 weeks, 4 weeks and then 5 weeks. At the end of the 5 week period you repeat the 4-4-5 cycle. The acquired company’s fiscal year closely resembles a calendar year fiscal year. The acquiring company, in contrast, has a fiscal year that runs from February 1 of one year through January of the following year. Because of this January of the new year was combined with December of the prior calendar year just closed to form a one time 12th period that actually includes 2 months.

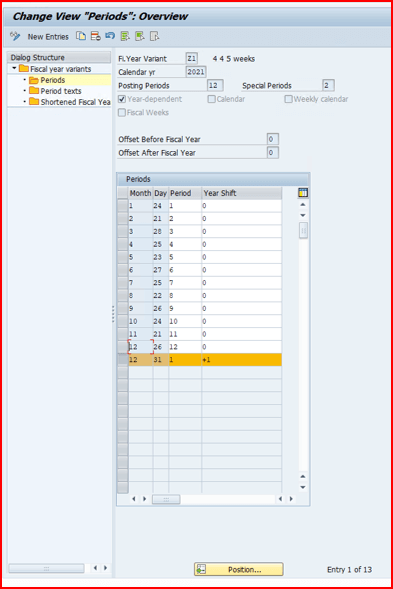

The changes all begin with transaction code OB29.

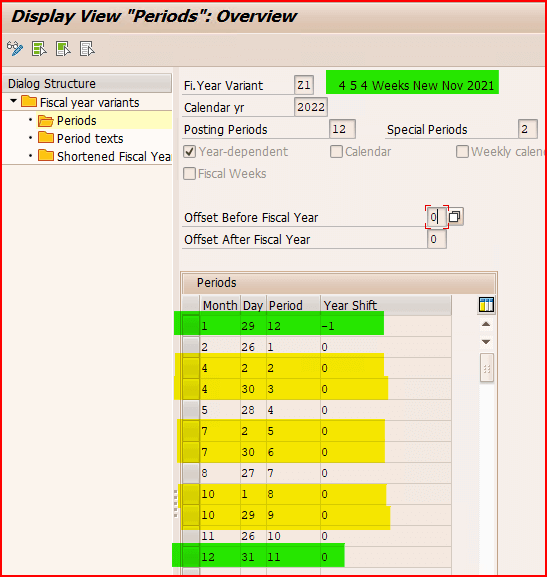

What you see here is the original 4-4-5 week fiscal year alignment. The month and day are the actual calendar month and day the period closes. Then you identify which period it is and leaving a 0 in the Year Shift column means that the calendar year and Fiscal Year are the same. When you end on a week instead of the actual month end day you get the oddity in the last row of this table. This table needs to be completed through the end of the calendar year. Since their FY ended on December 26 for 2021 that means you have 5 calendar days to account for so you add the last line.

This last line includes every day after 12/26/2021 through 12/31/2021 but notice it is Period 1 and the +1 means that the Period 1 is part of FY2022(2021 + 1)

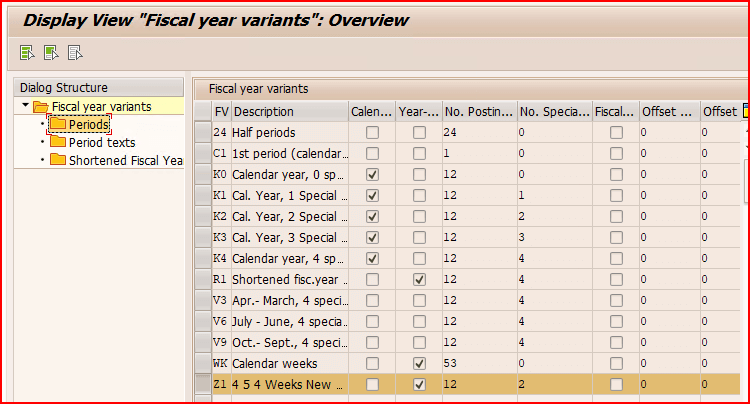

Now let’s take a look at the changes that need to be made in this table. I will show you a “new” FY2021 set up along with Fiscal Years 2022 and 2023.

So you go back into OB29 and select the Fiscal Year Variant and then click on Periods.

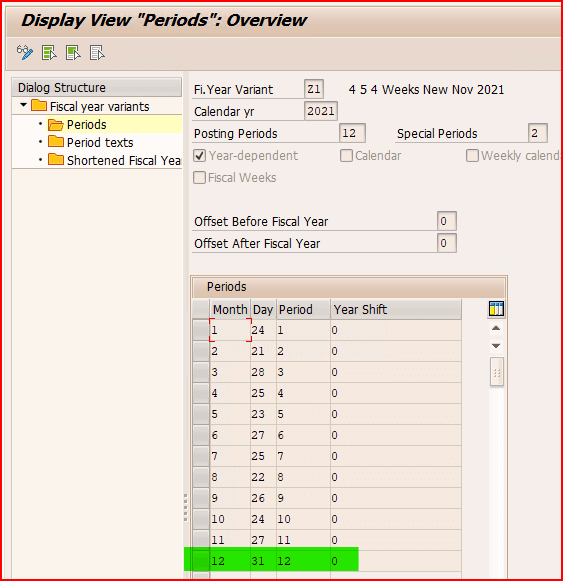

The new set up for FY2021 now includes the whole month of December in period 12. Now let’s look at FY2022.

Here we see some oddities when a business decides to break down periods by weeks instead of calendar month. Saturday is the day they are using as the end of the week. Here are the keys to notice in this screen print

- January is actually Part of period 12 for FY2021, remember this was a transition year so FY2021 period 12 includes weeks in both December, 2021 and January, 2022.

- During the year you have 3 calendar months when the first Saturday of the month is actually the end of the period for the previous month.

- For 2022 it just happens that Period 11 ends exactly on December 31st. This won’t always be the case.

- Period 12 2022 is not seen on this screen because period 12 for FY2022 is calendar month January, 2023.

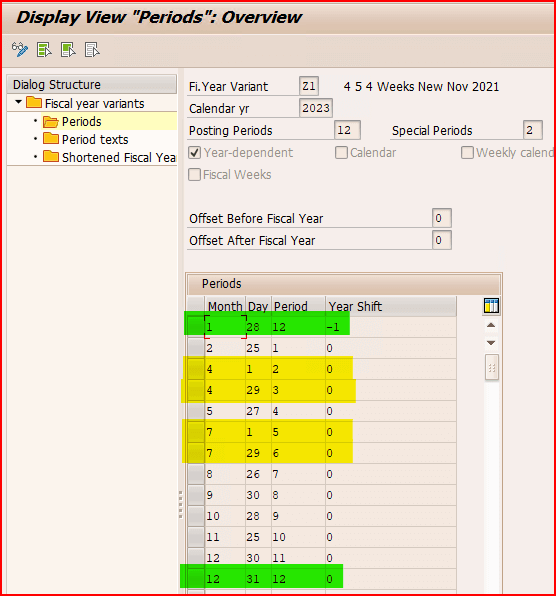

Now let’s look at one more year, FY2023, because it’s not impacted by the transition year of FY2021.

One more time let’s look at the key points in this screen shot.

- Now you see that January through 01/28/2023 is actually period 12 for FY2022

- This time we only have 2 calendar months when the first Saturday of the month is the end of one fiscal period while the last Saturday of the month is also the end of a period.

- Notice Period 11 ends on 12/30/2023 as a result 12/31/2023 is actually the first day of period 12 FY2023.

At this point I’d like to mention how this impacts the period in the MM Module. When you open a period with MMPV in the MM module whatever period is open, it’s linked directly to the same Fiscal Period in FI. For example, documents that are post in January, 2022 post to Period 12, FY2021. So as long as the material movement falls within a legitimate date range it will post to the same Fiscal Year and Fiscal Period as the FI documents.

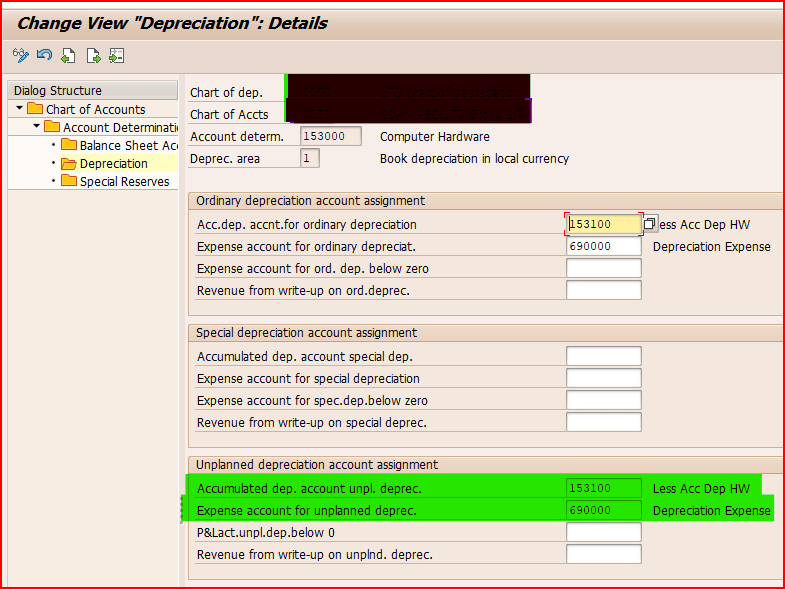

In the final piece to this I’d like to cover how it impacts Fixed Assets. First and foremost in the year of transition you may need to post “unplanned” depreciation so first make sure you have automatic GL Account assignment set up in t-code AO90 for “Unplanned depreciation account assignment” section.

This is required because posting depreciation with t-code AFAB takes the annual amount of depreciation and divides it by 12 for straight line depreciation. In this example a 13th month was added to FY2021 so I had to account for that extra month of depreciation. To account for the additional depreciation one needs to use t-code ABAA and post “unplanned” depreciation. So it’s a three step process.

- Execute AFAB for the normal depreciation run

- Post the unplanned depreciation for the additional fiscal year period

- Re-run AFAB for the period using the “Repeat” mode.

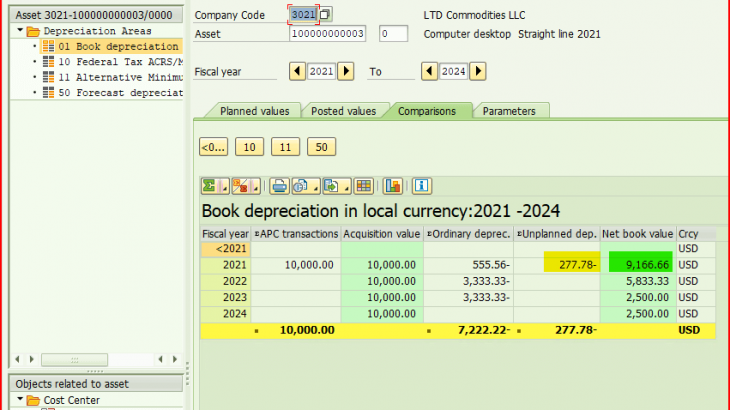

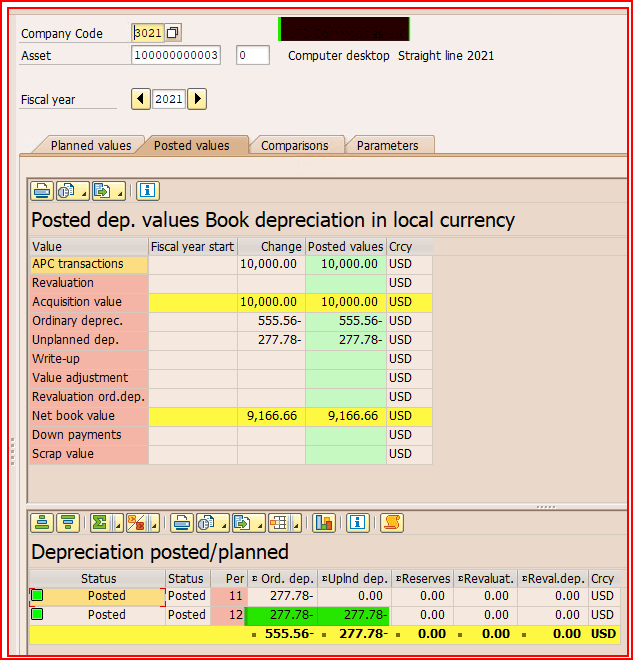

Here is an asset acquired in period 11 FY2021 that was handled this way at the end of FY2021.

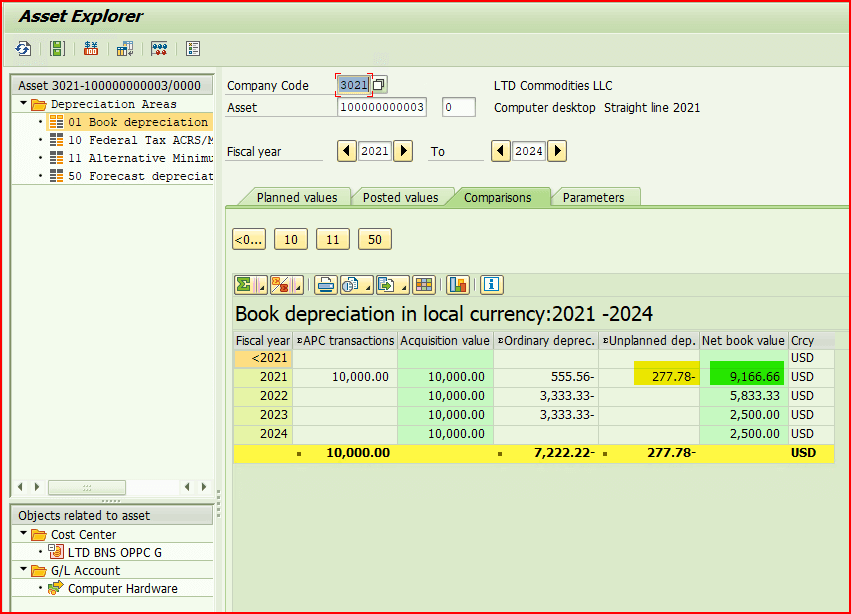

Using AW01N you can view the results. The planned depreciation amount was $277.78 per month. You can see here that Period 11 & 12 depreciation was post as Ordinary Depreciation while January, 2022 Depreciation was post with the ABAA as “unplanned” for the same monthly amount. Now look at the Comparison Tab in AW01N:

The key here is that the Net Book Value is reduced by both the Ordinary Depreciation and the Unplanned amounts so the timing of when the asset will be fully depreciated will stay the same as expected without the Fiscal Year change.

This process has proven to be very successful for when a Fiscal Year Change has involved extending the transitional fiscal year.