In SAP, things are continuously changing and becoming more compatible with real-time scenarios. One of the changes is parallel currency; their business can use multiple currencies for company codes. The parallel currency functionality can assist multi-national corporations in recording their financial transaction and producing financial reports in several currencies.

Introduction

The blog approaches the real-time business requirement of having multiple currencies in company code. With the recommended configurational steps and assignments below, we can set up company code to post all financial documents with multiple real-time currencies. There are a lot of blogs and information on SCN regarding the currencies in S/4HANA, and I just tried to consolidate all the information in one blog with my experience.

Objective

In this detailed blog, we will try to explore the following SAP standard functionalities with a real-time scenario

- Currency Keys

- Currency types

- Currency Keys & Currency Types Assignments

- Currency Types & Company Code Assignments

- Currency Exchange Rates

- Journal Voucher Posting

- Line-Item Report Analysis

1. Currency Keys

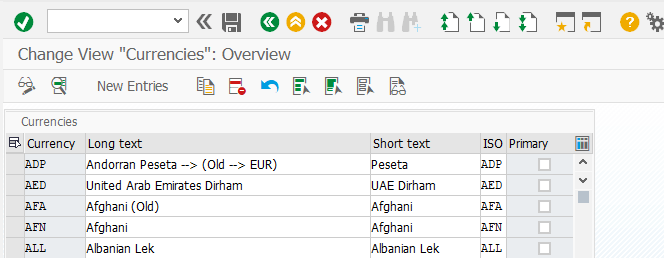

Currency keys or currency codes are identical alphabetical codes for the recordation of transactions where the amounts are managed with currency keys in the SAP system such as USD, EUR, INR & PKR. We have an option to select the currency key almost in all the transactional T-Codes to specify the currency of the transaction or document.

- SPRO-> SAP NetWeaver-> General settings-> Currencies-> Check Currency Codes

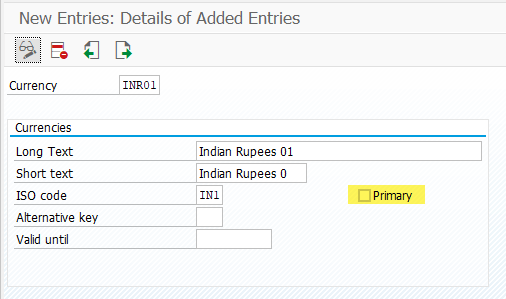

SAP has already defined all the worldwide used currencies in a system with ISO global standard marks as general settings and provides the Independence to define new currency codes in the system as well with 5-character alpha-numeric currency keys with alpha-numeric ISO codes, or you can use several currency keys with same ISO code with “Primary” Check box. (Highlighted in the below screenshot)

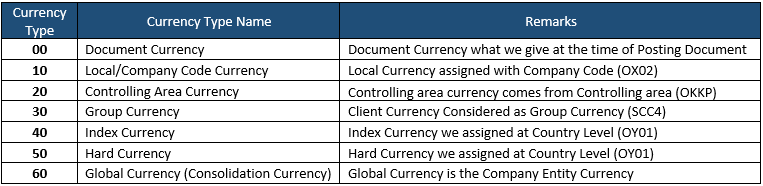

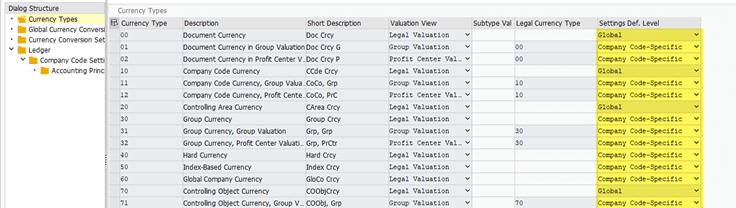

2. Currency Types

Currency types are another essential functionality of SAP. The currency type specifies the role of a currency in the SAP system. We cannot directly assign any currency key to the ledger; instead, we set the currencies to organizational entities or units, as per business scenario, and the system automatically assigns the currency keys to currency types.

For example, suppose we assign the SAR to a company code in the T-Code OX02. In that case, the system automatically considers it as company code currency or local currency. Automatically, SAR is assigned with currency type 10, and the same currency type will be given to the ledger and Company Code.

Let’s explore the currency types and their assignments in the SAP S/4HANA system.

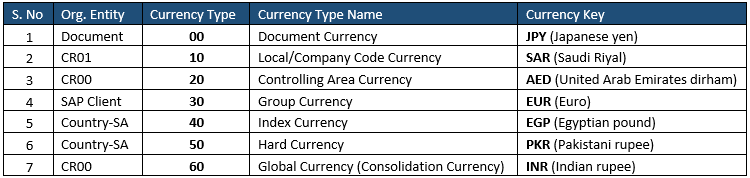

- Document Currency (00) – Document or transaction currency is just the currency of financial documents. This currency has no relation with any of the organization’s units. If we post the customer invoice in JPY (Japanese Yen), our document currency will be JPY (Japanese Yen). S/4HANA system will check the latest maintained exchange rates and convert the document currency into our organizational units’ currencies.

- Company Code Currency (10) – Company code is an independent organizational unit, and we assign the currency to the company code. Currency given with company code is considered as company code currency.

- Controlling Area Currency (20) – In the controlling area, we can select the currency type 20 and assign any currency key to the controlling area. Currency given with the Controlling area will be considered as Controlling area currency. Here the recommendation is not to use controlling area currency. We can use any other currency type, such as Group currency, Hard Currency, and Index Currency.

- Group Currency (30) – Group Currency is the client currency of the SAP S/4HANA system, configured at the time of client configuration. We can display it in T-code SCC4 or Table T000. The currency assigned to the client depends on the business requirement.

- Index-based Currency (40) – index Based Currency is fictitious and country-based. This currency assists businesses in reporting their financials in abnormal periods such as high degrees of inflation or an emergency.

- Hard Currency (50) – Hard Currency can be the secondary currency for the country and can assist in inflation or any abnormal period of time like index-based currency. It is also a country-based currency and assigned to the country in T-Code OY01.

- Global Company Currency (60) – Company code can represent the region, division, or country in organizational structure. It may have separate currencies, so company currency can assist in consolidating reporting. We can have consolidation reporting in the business desired currency by assigning the currency to the company. Company currency is also known as “Global Company Currency” or “Consolidation currency.”

Tabular Summary Of Currency Types

Now we have a proper basic understanding of currency types and keys; hence we can move further to assign the currency keys to organizational units. We shall also explore how one organizational unit will be assigned to another entity.

3. Currency Key and Currency Type Assignments

We must create organizational units and assign desired currency keys to units per business requirements. These organizational entities will help with financial and managerial reporting, and their assigned currencies will provide the freedom to draw the report with desired or given currency.

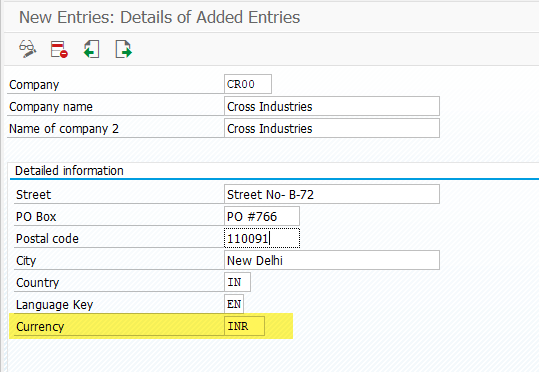

A. Define Company in Enterprise Structure

The company is at the highest level of organizational structure in SAP FI. This organizational unit can help the business to consolidate reporting over company codes. The company’s entity Currency will be Global Company Currency or consolidation currency (Currency type 60). Whatever currency we shall assign to the company while creating will be global company currency.

- SPRO-> Enterprise Structure-> Financial Accounting->Define company

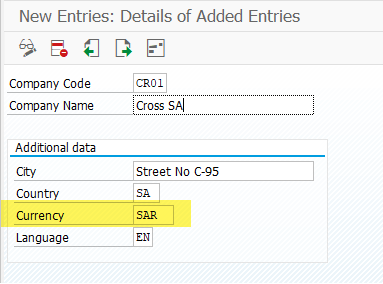

B. Define Company Codes in Enterprise Structure

Company code can represent the region, division, or country in business organizational structure for the external accounting. We can assign different currencies to different company codes, and the currency of the company code will be considered as local currency or company code currency (Currency type 10)

- SPRO-> Enterprise Structure-> Definition-> Financial Accounting-> Edit, Copy, Delete, Check Company Code

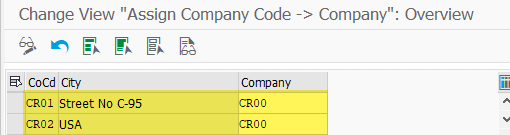

C. Company & Company Code Assignment

Here, we assign company codes to the company so the system can identify the enterprise units and currencies for consolidation reporting.

- SPRO-> Enterprise Structure-> Assignment-> Financial Accounting-> Assign company code to company

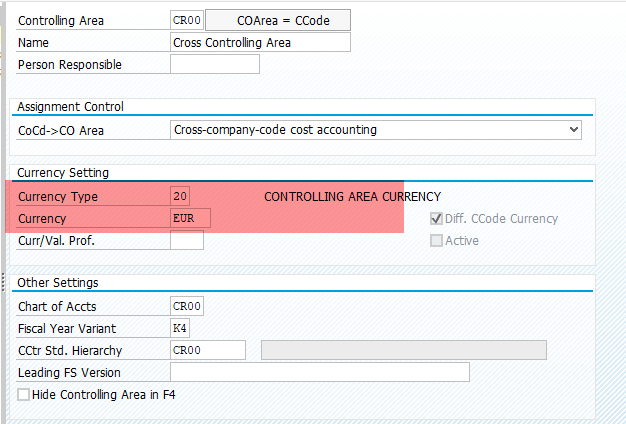

D. Controlling Area Currency

Controlling area is also the part of business organization which assists us for cost or management accounting purposes. The controlling area can have different currency from company codes, and several company codes can be assigned to the controlling area. If we select the controlling area currency (Currency type 20) and assign EUR in the controlling area, then EUR will be the controlling area currency in our parallel currencies.

- SPRO-> Enterprise Structure-> Definition-> Controlling-> Maintain Controlling Area

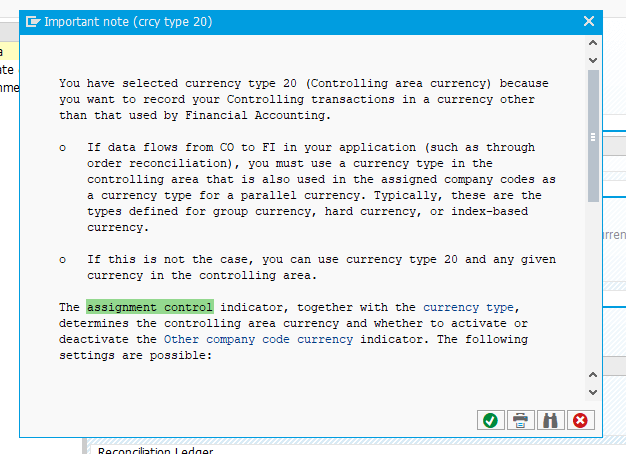

Important Note from SAP regarding the currency type 20 (Controlling area currency)

As per best practice and recommendation, we should not use currency type 20. Instead of Controlling area currency, we can use group, hard or index-based currency for management accounting purposes.

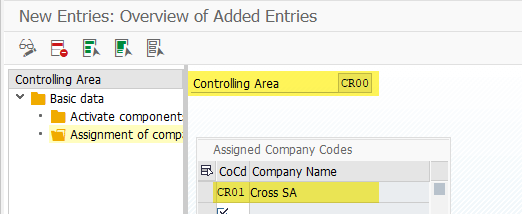

E. Controlling Area & Company Code Assignment (OX19)

Assigning the controlling area with a company code to link the financial and management accounting and their currencies is mandatory.

- SPRO-> Enterprise Structure-> Assignment-> Controlling-> Assign company code to controlling area

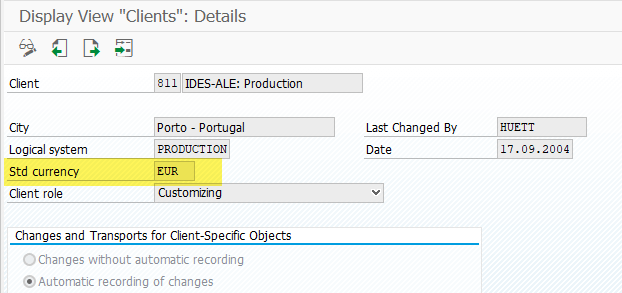

F. Client Administration (SCC4)

The client is a commercial, organizational unit in SAP S/4 HANA System, and It has its own set of master data with independent table sets. Client Currency is the only currency known as Group Currency (Currency type 30). In Short, the Client is at the highest level in the organizational hierarchy. Client currency is permanently assigned at the time of client configurations by the administration.

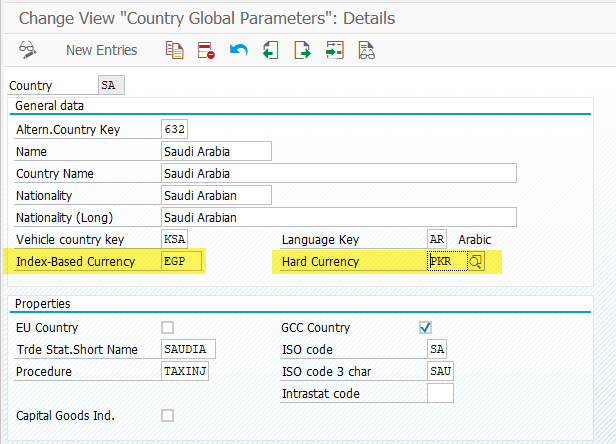

G. Index Currency & Hard Currency

Hard Currency or Index-based currency is that currency issued by a nation that is seen as politically and economically stable. Index and Hard, both the currencies, must be maintained at the country level. In our ongoing example, the country is Saudi Arabia; hence we have to keep both currencies in the country Saudi Arabia (SA).

- SPRO-> SAP NetWeaver-> General settings-> Set Countries-> Define Countries in mySAP Systems

As per the above assignment, EGP will be index-Based Currency, and Hard currency will be PKR.

4. Assign Currency Types to Company code and Ledger

After assigning all required currencies to organizational entities, we must assign currency types to the company code. In this vital step, we must maintain the leading ledger too.

- SPRO-> Financial Accounting-> Financial Accounting Global Settings-> Ledgers-> Ledger-> Define Settings for Ledgers and Currency Types

A. Currency types

Here we must tell the system which currency type will be used at the client or company code levels.

Company Code Currencies only can be defined for company codes. Global Currencies will be fixed for all the Company codes in the same client.

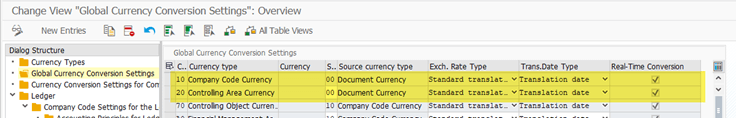

B. Global Currencies Conversion Settings

For Global Currencies, we must tell the system the “Source Currency” & Exchange Rate Type with a Translation Date type. Let’s make the base theoretically sharp before starting the crucial configuration.

Source Currency -> The currency system will convert to the target currency. We are selecting the “Document Currency,” which means SAP S/4HANA System that will Convert the amount from Document Currency into desired and assigned Currencies. Document Currency can be any currency, whichever we are entering when posting the financial Documents.

Exchange Rate Type -> we can use several exchange rates for particular currency pair with the “Exchange Rate Type” functionality. For example, any business can maintain a different exchange rate for the same currency pair for the same period, say, Different exchange rates for import transactions and different exchange rates for export transactions.

We must maintain the exchange rate type for a particular foreign currency exchange rate, such as M (Standard Translation), against the currency type. The system will opt only for that exchange rate maintained with exchange rate type M for the conversion.

Here is the list of some standard exchange rate types, and let’s look at these as well.

Exchange Rate Type G -> Bank buying rate, also known as the purchase price. It is the rate at which banks buy foreign currencies from customers and companies. This exchange rate is mainly maintained for export purposes.

Exchange Rate Type B -> It is the rate banks sell foreign currency to customers/companies. This exchange rate is used to import purposes.

Exchange Rate Type M-> This is an average rate of the above exchange rate types and is commonly used for currency valuation across worldwide multinational companies.

Translation date Type – A translation date is a date used to convert the foreign currency to local currency. Since the exchange rate is picked based on the translation date, it is a very critical date component. In standard SAP, the translation date is automatically derived from the posting date, or we can select the posting date or document date for the exchange rate conversion.

Real-Time Conversion -> If the real-time conversion is active, the SAP system will convert the document as it gets posted; otherwise, it will convert at the time of foreign currency valuation.

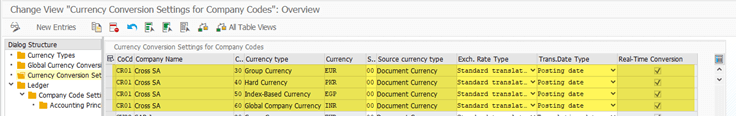

C. Currency Conversion Settings for Company Codes

If the currency type is defined at the company code level, we must maintain the currency type for the company code.

Currency of currency types will be fetched automatically from organizational hierarchy units.

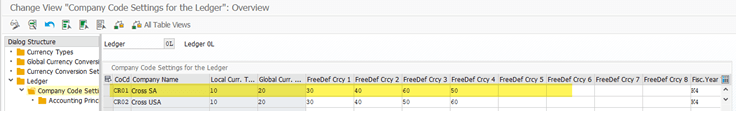

D. Currency Types & Ledger Assignment

Here, in this critical step, we must assign all the currency types, including global and company code, specific to company code & ledger.

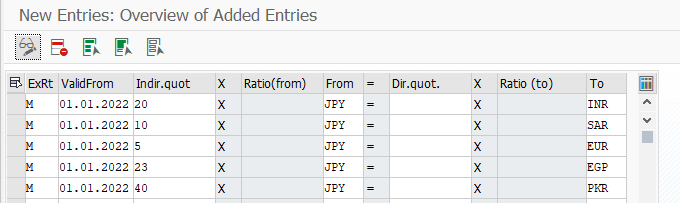

5. Maintain Foreign Exchange Rates (OB08)

We also must maintain the exchange rates between different currencies before posting any financial transaction. The system will convert all currencies based on the newly updated exchange rates in OB08. We also can upload the exchange rates through T-Code TBEX.

- SAP Menu-> Accounting-> Financial Accounting-> General Ledger-> Environment-> Current Settings-> S_BCE_68000174 – Enter Translation Rates

6. Journal Voucher Posting (FB50)

Whatever Currency we will give in the financial document will be considered as “Document Currency” (Currency type 00), and it can be any currency per business requirements for day-to-day transactions.

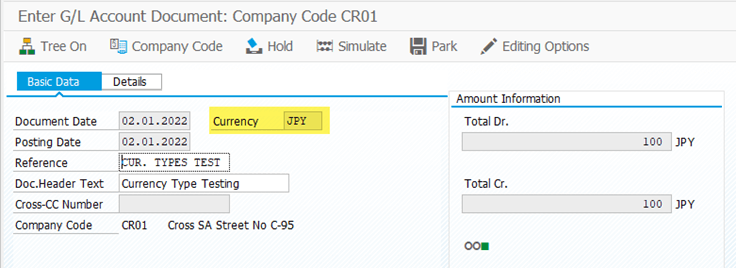

A. Basic Data Tab – FB50

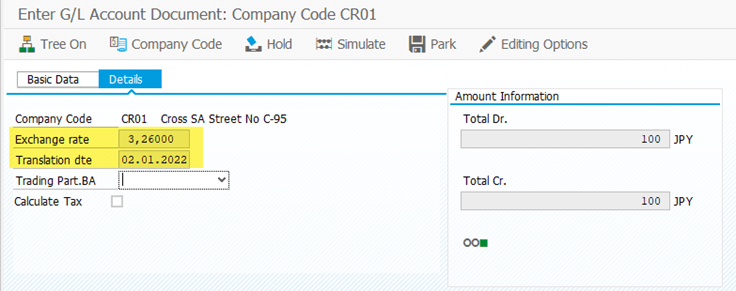

B. Details Tab – FB50

The exchange rate in the details tab will appear for only Document Currency to Local Currency conversion. Here we also can change the Exchange Rate for the Same Currency Conversion. For all other conversions, the exchange rate will take place only through OB08. (Table TCURR)

With the above exchange rate and translation date financial document has been posted.

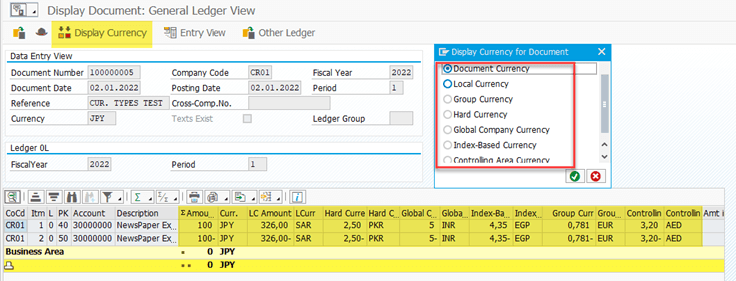

Posted Accounting Document Display in General ledger View

Document posted successfully in all below maintained currencies

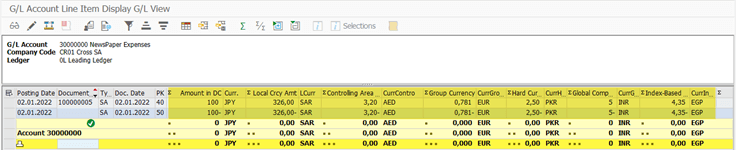

7. General Ledger Account Line-Item Report

We can have a list of all the currency types and their currency amount in the general ledger account line-item report – FAGLL03

8. Summary

With the help of all the configurational steps and assignments, we can achieve the parallel currency in SAP S/4HANA System. All the financial documents will be posted with assigned currency types, including asset depreciation documents. This functionality can help multi-national companies to maintain their financial records in different currencies.