1. Overview

Cash pooling / Cash concentration is a financial management strategy that lets companies maximize their current credit and debit cash positions to optimize the use of surplus funds of all subsidiaries in a group, reduce external debt, and increase available liquidity.

Physically, via concentration by sweeping accounts upward, the concentration account can bring together cash for the purposes of managing liquidity. Surplus funds can be concentrated into the account allowing greater interest payments and better management. Where-as, via distribution by sweeping down, it can assure that accounts do not go into overdraft. It also improves visibility to your cash and liquidity management.

2. Prerequisites

To perform Cash Concentration, funds in bank accounts move from one bank to another. Following settings are required to enable bank to bank transfer:

2.1 Settings for Bank to Bank Transfer

- Financial Accounting >> Bank Accounting >> Business Transactions >> Payment Transactions >> Payment Request >> Define Clearing Accts for Receiving Bank for Acct. Transfer

- Financial Accounting >> Bank Accounting >> Business Transactions >> Payment Transactions >> Payment Handling >> Bank Clearing Account Determination >> Define Account Determination

2.2 Bank Account Balance Profile

you define Balance profiles for the calculation of bank account balance in cash concentration. You then assign planning levels that represent the source and use of cash flows to these profiles. By assigning different planning levels, various forms of profiles can be predefined and are used in the cash sweeping between the header account and subaccounts. Following settings are required:

Financial Supply Chain Management >> Cash and Liquidity Management >> Cash Management >> Bank Account Balance Calculation

- Define profiles for the calculation of bank account balances

- Assign planning levels

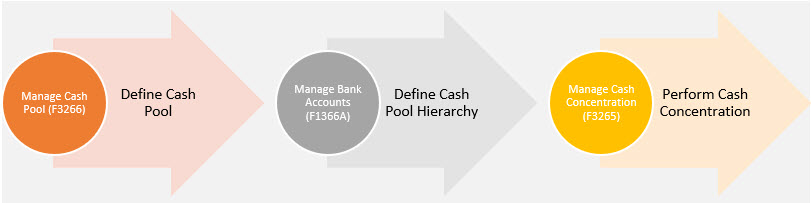

3. Process Steps

Below diagram depicts the process steps for Cash Concentration:

3.1 Define Cash Pools

A cash pool is a structure involving several related bank accounts whose balances are aggregated for the purposes of improving liquidity management. A cash pool consists of one leading bank account and multiple participating bank accounts which are referred as header account and subaccounts respectively.

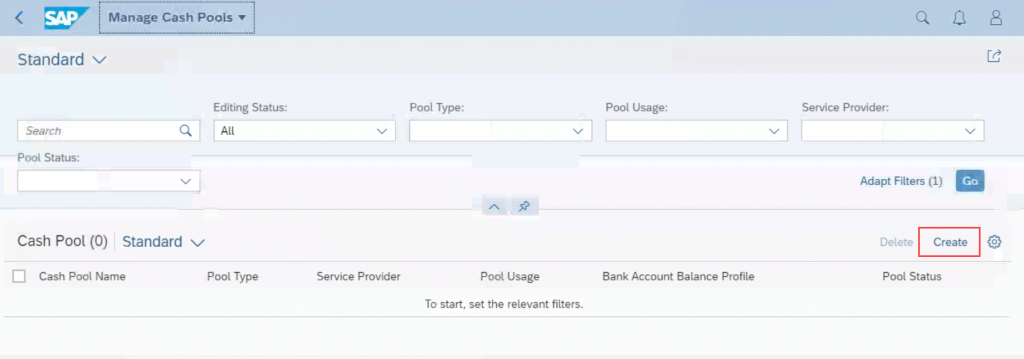

Fiori App – Manage Cash Pools (F3266)

With this app, you can manage cash pools centrally that aggregate the amounts of all the assigned bank accounts. The cash pools can later be used in pooling cash between the assigned header accounts and subaccounts. This cash pooling feature can help your company to improve its liquidity management.

Key Features:

- Create cash pools. You can enter details, such as description, pool type, service providers and so on

- Display a list of cash pools to check the details for each pool

- Filter cash pools with specific selection criteria, such as Pool Usage to see whether it’s used for cash concentration or not.

- Delete cash pools that are not in use anymore. Even though cash pools are deleted, you can still display them in a list.

Process Steps

- Open the Manage Cash Pools app

- To create a new cash pool, choose the Add (+) icon

- Specify the required fields such as the cash pool name and description

- Specify the cash pool type as Physical

- Specify the service provider for this cash pool. There are the following two Service Providers:

- Bank – The cash pool is operated by a bank. The bank is responsible for the cash concentration and distribution activities so manual cash concentration is not supported for this type of cash pool. Pool Usage of this type should be Both Directions.

- Enterprise – The cash pool is operated by your company. You can initiate cash concentration manually or schedule jobs for cash concentration.

- Bank – The cash pool is operated by a bank. The bank is responsible for the cash concentration and distribution activities so manual cash concentration is not supported for this type of cash pool. Pool Usage of this type should be Both Directions.

- Select from one of the following pool usage options:

- Both Direction – mutual cash movements between the header account and the subaccounts

- Cash Distribution – cash movement only from the subaccounts to the header account

- Cash Concentration – cash movement only from the header account to the subaccounts

- Both Direction – mutual cash movements between the header account and the subaccounts

- Specify the Bank Account Balance Profile. The profile is used to calculate bank account balances in cash concentration.

3.2 Define Cash Pool Hierarchies

Fiori App – Manage Bank Accounts (F1366A)

After cash pools are defined in the Manage Cash Pools app, you can assign bank accounts to cash pools and define cash pool hierarchies in the bank account master data.

Key Features

This app will allow you to specify the bank account as Header or Subaccount for Cash Pooling purposes. Based on the assignment, the system will create the following two types of hierarchies:

- Single Layer hierarchy

- Multi-layer hierarchy

Please refer to section 5 “Scenarios” of this document for more information on these hierarchies.

Process Steps

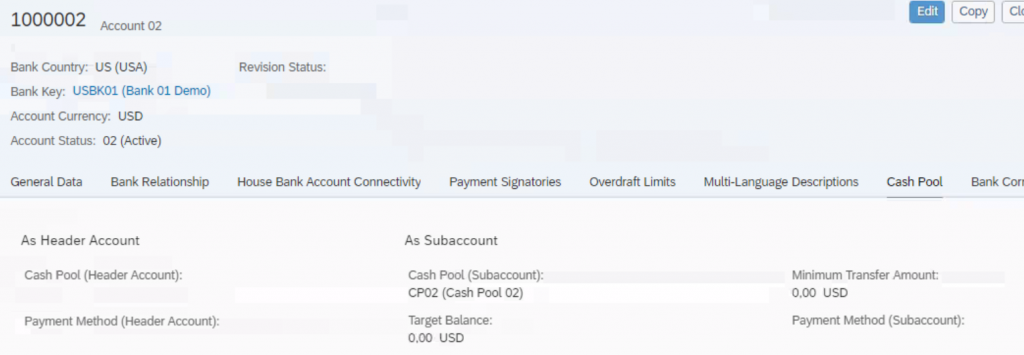

- In the Manage Bank Accounts app, open a bank account record, and then go to the Cash Pool section.

- Specify the following:

- If the bank account serves as the header account of a cash pool, in the “As Header Account” section, specify the cash pool. Specify the Payment Method. To do so, after you specify the Cash Pool Name field, press Enter to enable the Payment Method field for editing.

- If the bank account serves as a subaccount of a cash pool, in the “As Subaccount” area, specify the cash pool information. The following values are only relevant when the cash pool is a physical cash pool.

- Target balance

- Minimum transfer amount

- Payment method

- Target balance

- If the bank account serves as the header account of a cash pool, in the “As Header Account” section, specify the cash pool. Specify the Payment Method. To do so, after you specify the Cash Pool Name field, press Enter to enable the Payment Method field for editing.

3.3 Perform Cash Concentration

Fiori App – Manage Cash Concentration (F3265)

With this app, you can perform cash concentration for cash pools with the service provider Enterprise. You can make transfers between the header account and subaccounts based on system proposals. The cash concentration feature allows your company to maintain cash balances centrally, and thus improve the efficiency of cash management.

Key Features

You can use this app to do the following:

- Perform cash concentration for physical cash pools with the service provider Enterprise.

- Get system proposals on transfer amounts and view simulation details for transfers in child cash pools.

- Filter cash concentration with specific selection criteria, such as the specified concentration date.

- Display cash concentration in a list page and check the application logs

Process Steps

- From the SAP Fiori launchpad, open the Manage Cash Concentration app.

- To start a cash concentration, choose the Add (+) icon.

- To specify a cash pool for cash concentration, choose the Specify Cash Pool button.

- In the dialog, select a cash pool that is still in use for the Cash Pool Name field. The cash pool must have the service provider as Enterprise.

- If needed, you can change the default Exchange Rate Type.

- Specify a plan date for simulating the cash concentration. The Balance Before field then displays the balance for the plan date that you have specified. The date can be the current date or a future date.

- To start generating cash concentration proposals, choose the Specify Cash Pool button to save your inputs.

- The system then displays the following:

- The Bank Accounts section – This section gives you an overview of the header account and all the immediate subaccounts of this cash pool. If a subaccount works also as the header account of a child cash pool, the cash pool information is displayed.The system proposes transfer amounts for each subaccount. You can decide whether to accept them or adjust according to your own needs. The transfer amount can be positive or negative. A positive amount suggests that the bank account receives money while a negative amount means that money is transferred from this account to the header account.

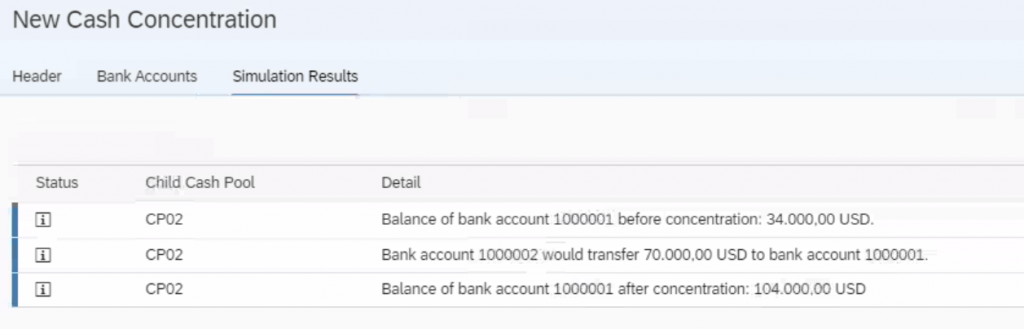

- The Simulation Results section – If there are child cash pools under this pool, you can see simulated cash transfer logs in this section. The simulation results explain how the Balance Before figures of the child cash pools are calculated. (Refer section 5.2 for more details.

- The Bank Accounts section – This section gives you an overview of the header account and all the immediate subaccounts of this cash pool. If a subaccount works also as the header account of a child cash pool, the cash pool information is displayed.The system proposes transfer amounts for each subaccount. You can decide whether to accept them or adjust according to your own needs. The transfer amount can be positive or negative. A positive amount suggests that the bank account receives money while a negative amount means that money is transferred from this account to the header account.

- Review the simulation results and adjust the transfer amounts when necessary.

- Save your changes. The system creates payment requests accordingly and generates an ID for the cash concentration.

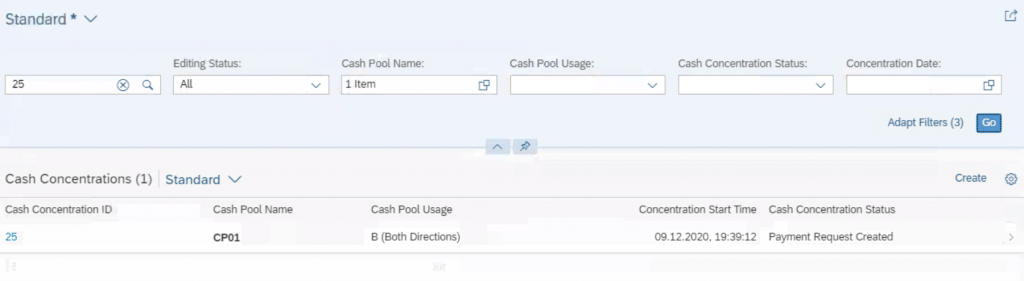

- Go back to the list page to check the cash concentration status.

- If the status is Error, from the list page, click on the concentration ID to view the application log. You can try again after fixing the errors.

- If the status is Payment Request Created, make a note of the payment request numbers, and then create payments using the Automatic Payment Transactions for Payment Requests transaction (transaction code F111). Alternatively, you can use the Make Bank Transfers (F0691) app to pay the relevant payment requests.

- If the status is Error, from the list page, click on the concentration ID to view the application log. You can try again after fixing the errors.

- You can track your cash pool transfers using the “Cash Pool Transfer Report” app.

- After the payments are made and confirmed by bank statement postings, you can check the transfers in this app.

4. Supporting Processes

4.1 Cash pool Transfer Report

Fiori App – Cash Pool Transfer Report (W0129)

With this app, you can get a daily report of concentration amounts in a cash pool. You can then track the funds transfer between header accounts and subaccounts in a specified period. Dynamic dimensions are available for you to make adjustments.

Key Feature

- View the daily transfer amount by cash pools in a predefined dimension with currency, header account and subaccount.

- Filter, sort and drill down the data according to specific formats.

- Extend the dimension of rows and columns in the Navigation Panel area.

- Navigate to the other cash management apps in the Jump to area.

4.2 Schedule Jobs for Cash Concentration

Fiori App – Schedule Jobs for Cash Concentration (F3688)

With this app you can schedule jobs for cash concentration using the template and scheduling options provided. You can define jobs for each cash pool and check the status of your cash concentration jobs.

Key Features

- Create and schedule jobs for cash concentration according to your requirements

- You can either start the job immediately or you can plan it to start later. The job is then carried out in background mode. You can define whether the job should recur and set up a recurrence schedule. Once you have defined all relevant parameters, you can check if the specified data is ok and schedule the job. The new job will appear in the Application Jobs list.

- View the results of the scheduled jobs

5. Scenarios

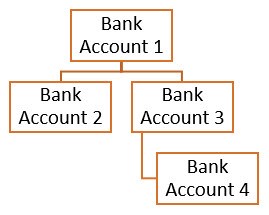

SAP S/4 HANA Cash Concentration can be performed with following two types of hierarchies:

Single Layer Cash Pool

In Single Layer cash pool, all bank accounts are assigned with Service provider “Enterprise”

Bank Account 1 – Header (Enterprise)

Bank Account 2 – Subaccount (Enterprise)

Bank Account 3 – Subaccount (Enterprise)

Multi-Layer Cash Pool

A multi-Layer cash pooling scheme is offered with a parent/header cash pool whose service provider must be Enterprise and subordinate cash pools (participating bank accounts of parent cash pool also acting as the leading account of other cash pools, if any) whose service provider must be Bank.

In such a pooling scheme, each participant (sub cash pool with service provider “Bank”) monitors and maintains its own accounts, no real amount transfers among them in this hierarchy at some point, however, all available balances in each relevant sub-pool are considered while performing cash concentration (for example, concentrated into the enterprise main account) in the parent cash pool (at top level).

To this end, it now allows the traceability of the net positions of all participating entities or accounts and a simulation of cash flow by sweeping accounts upward or down at the top layer in the hierarchy via the Manage Cash Concentration (F3265) app.

Bank Account 1 – Header (Enterprise)

Bank Account 2 – Subaccount (Enterprise)

Bank Account 3 – Header (Bank) Subaccount (Enterprise)

Bank Account 4 – Subaccount (Bank)

The following points are to be noted for Multi-Layer Cash Pool:

- Once a bank account becomes the Subaccount of a cash pool whose service provider is “Bank”, it can no longer be the header bank account of another cash pool whose service provider is “Enterprise”. It can only be the header of another cash pool with service provider “Bank”.

- Once a bank account becomes the subaccount of a cash pool whose service provider is “Enterprise”, it can no longer be the header bank account of another cash pool whose service provider is “Enterprise”. It can only be the header of another cash pool with service provider “Bank”.

- Once a bank account becomes the header account of a cash pool whose service provider is “Bank”, it can either be the sub-account of another cash pool whose service provider is “Enterprise” (top level cash pooling), or the sub account of another cash pool with service provider “Bank” (sub level cash pooling).

- Once a bank account becomes header of a cash pool whose service provider is Enterprise, it cannot be the sub account of any other cash pools (top level cash pooling). This bank account is regarded as the top / main account of the parent cash pool in the multil-layer cash pool hierarchy for performing concentration or distribution

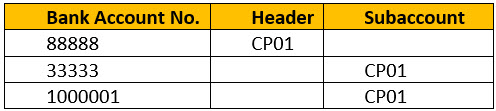

5.1 Single Layer Cash Pool – walk-through

We are going to create the Single layer Cash Pool as below:

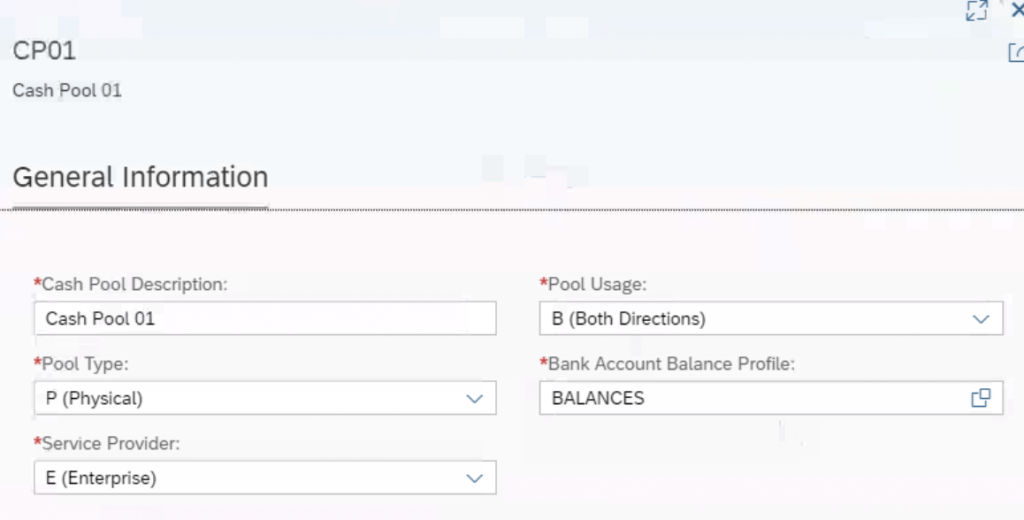

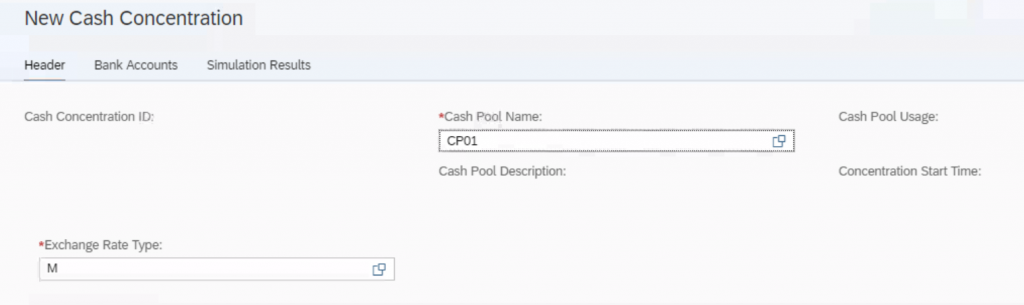

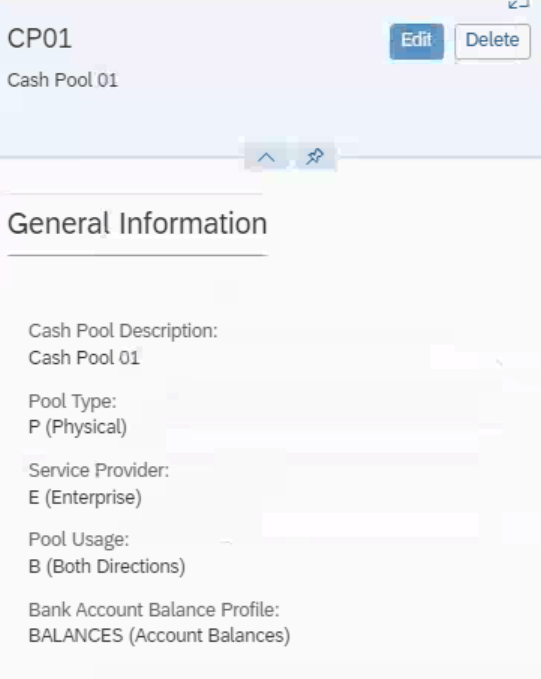

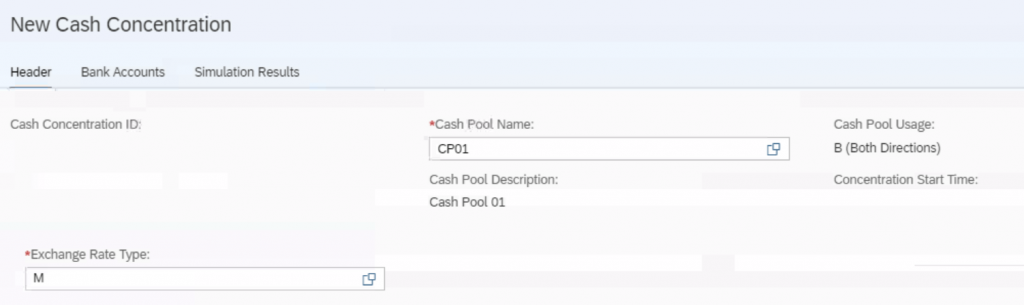

Cash Pool CP01 is created with service provider “Enterprise”.

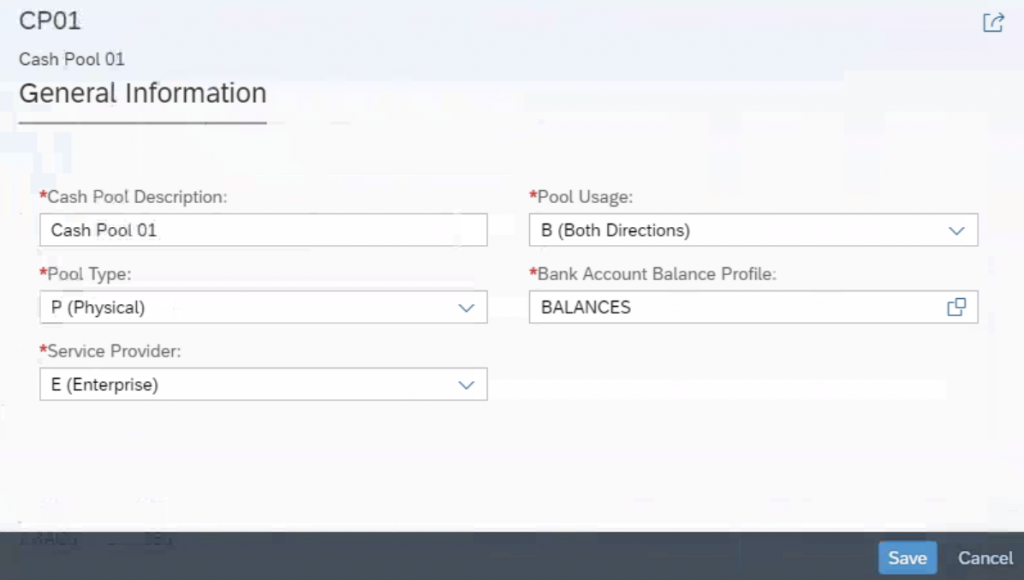

5.1.1 Create Cash pool

Fiori App – Manage Cash Pools

Enter below details for the cash pool and click on Save:

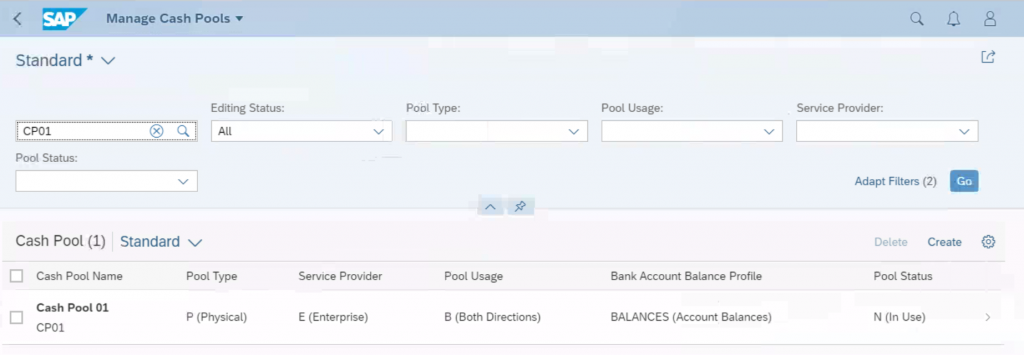

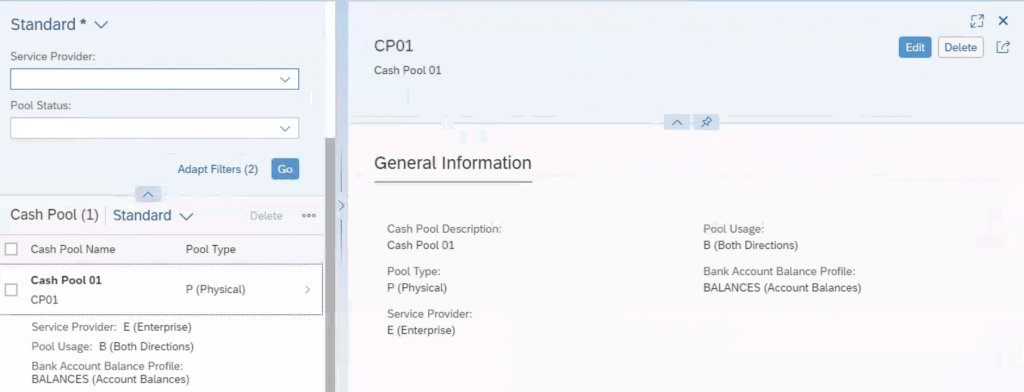

5.1.2 Display or Edit Cash Pool

Search Cash pool in same Fiori App “Manage Cash Pools”

Click on the cash pool to display

Click Edit to change the Cash Pool

5.1.3 Define Cash Pool Hierarchies

Go to Fiori App “Manage Bank Accounts”

Select the bank account number and click edit. Under Cash pool Tab enter the details and save:

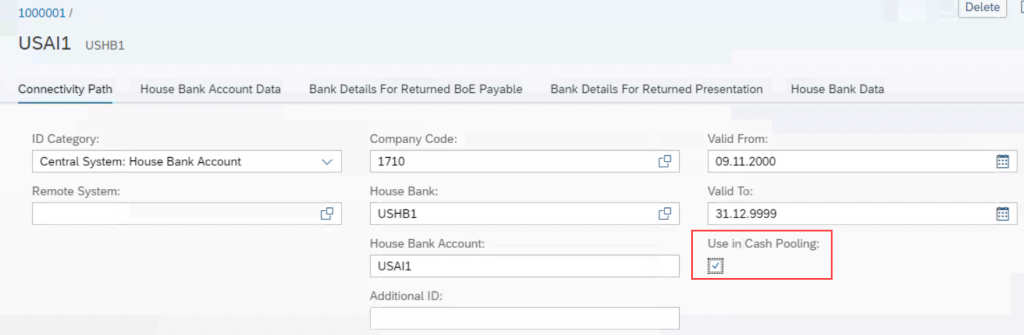

Make sure that “Use in Cash Pooling” is ticked in the house bank under the connectivity path.

5.1.4 Perform Cash Concentration

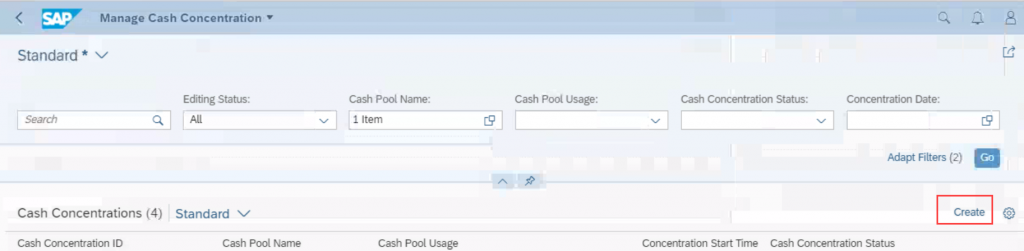

Go to Fiori App “Manage Cash Concentration”

Select Cash Pool name and hit enter

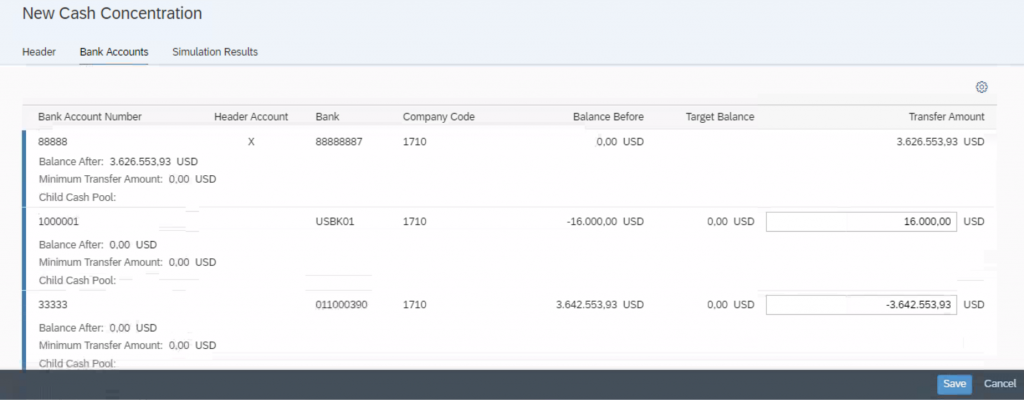

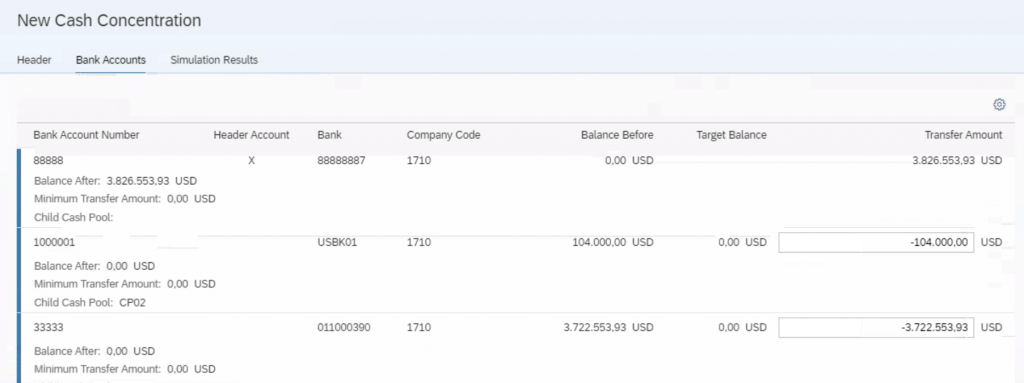

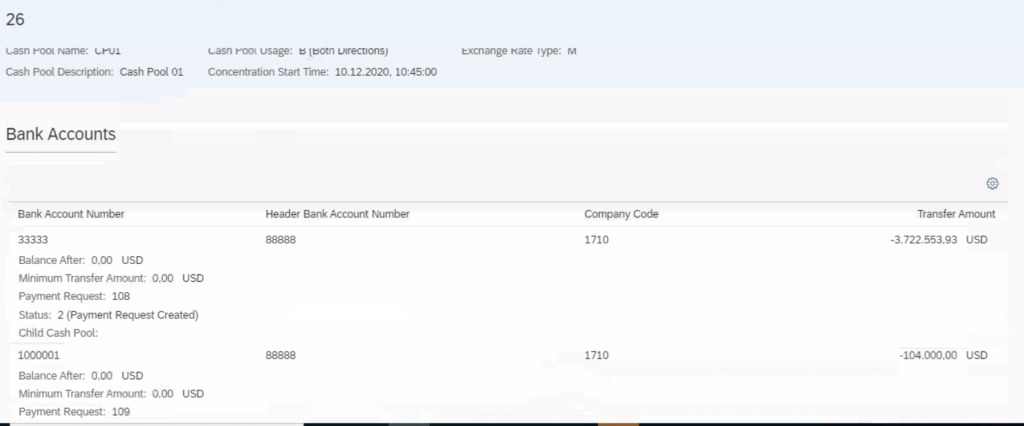

The system will display all the Cash pool relevant bank accounts with their current balance and target balance:

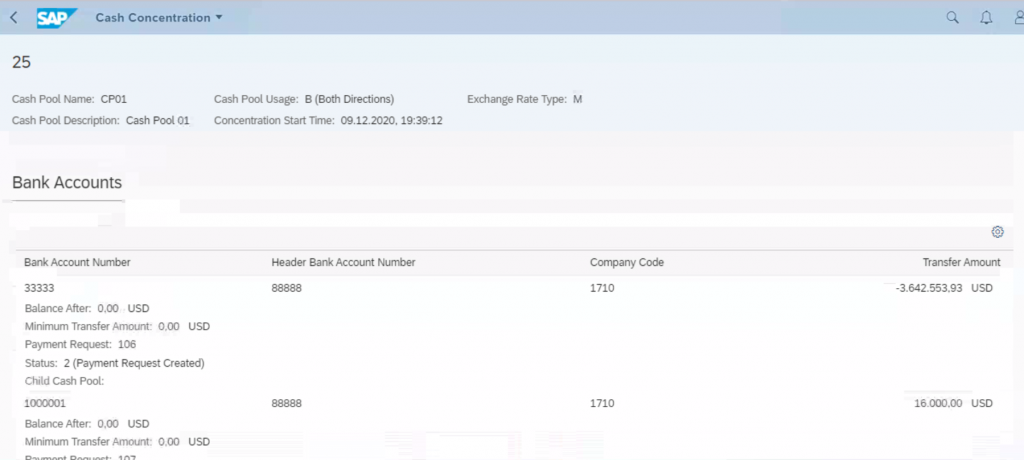

From the above screen, you can notice that Bank Account 88888 is the header account and 1000001 and 33333 are subaccount. Bank account 1000001 has a credit balance therefore this amount will be transferred from 88888. Bank account 33333 has a debit balance and therefore balance in this account will move to 88888.

Now click on Save. This will generate the concentration ID and will also generate the payment request number.

You can display the Cash Concentration in the same app:

The payment requests can be paid via Make Bank Transfers (F0691) app or via Payment program F111.

5.2 Multi-Layer Cash Pool – walk-through

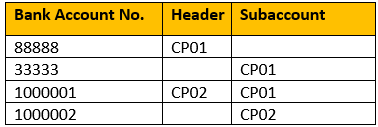

We will create a Multi-layer cash pool as below:

CP01 – Service provider “Enterprise”

CP02 – Service Provider “Bank”

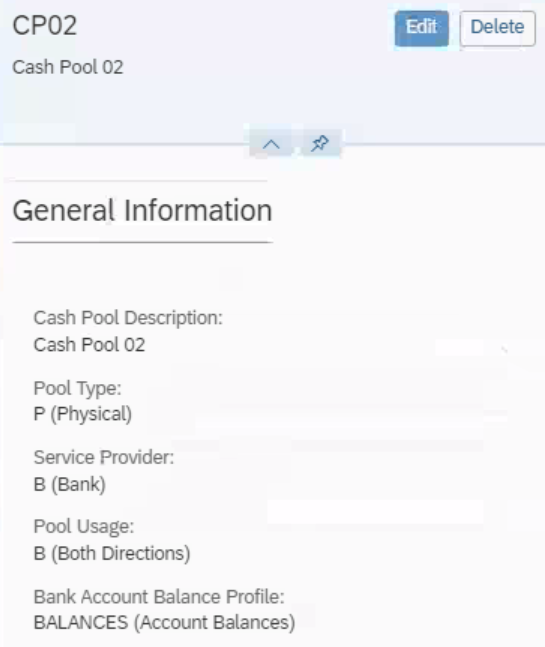

5.2.1 Create Cash Pool

Fiori App – Manage Cash Pools

Cash pool – CP01

Cash Pool – CP02

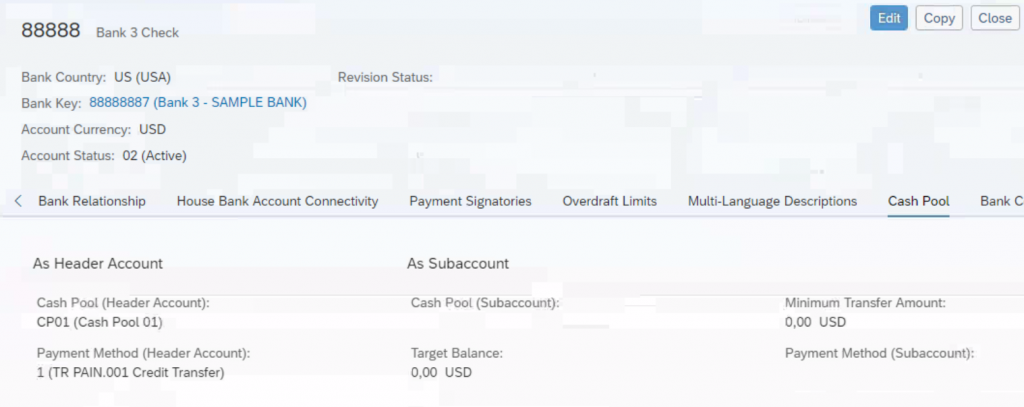

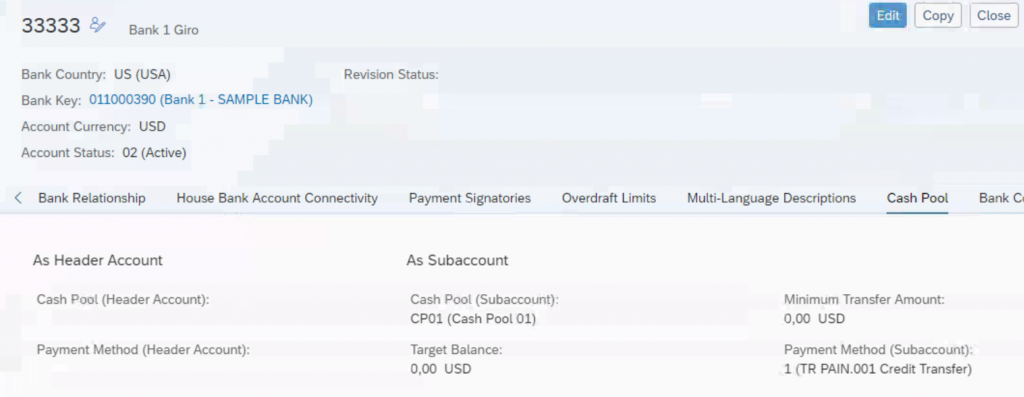

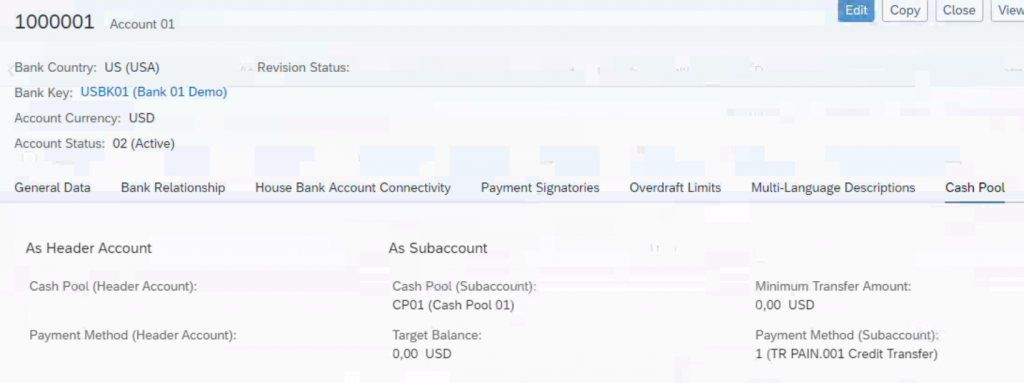

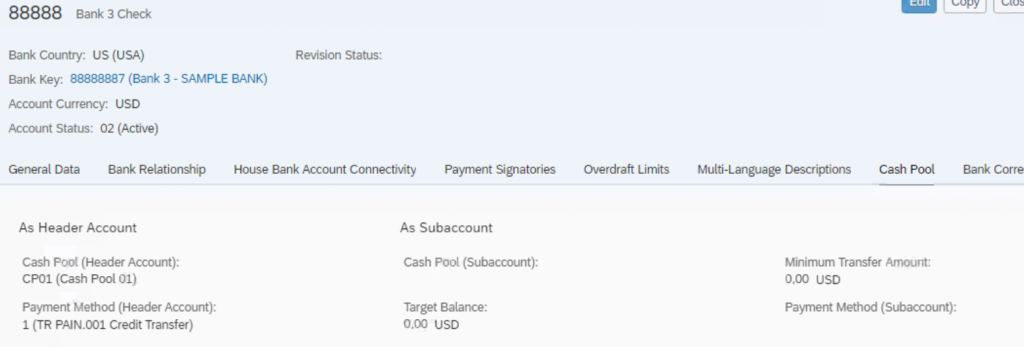

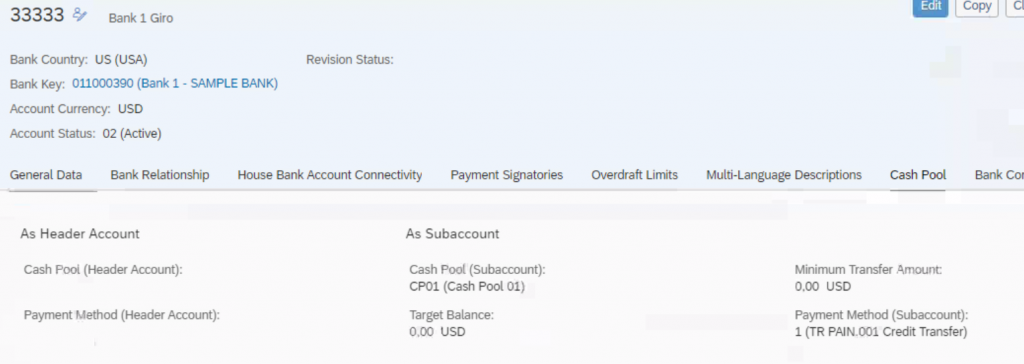

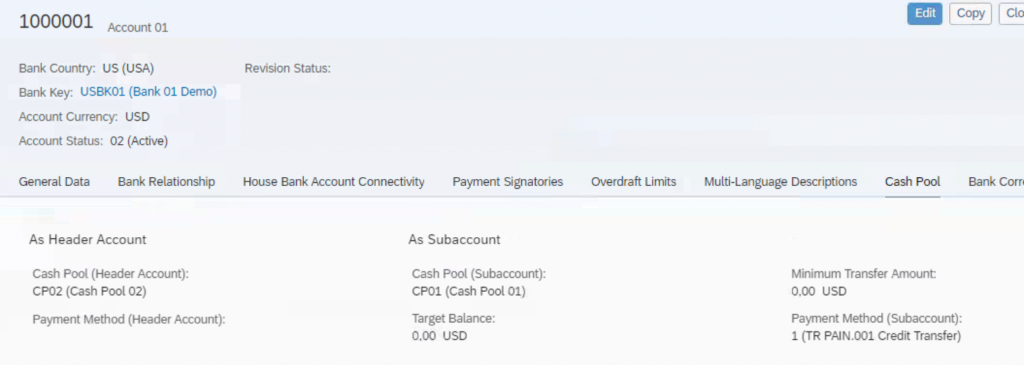

5.2.2 Define Cash Pool Hierarchies

Fiori App “Manage Bank Accounts”

Bank Account – 88888

Bank Account – 33333

Bank Account – 1000001

Bank Account – 1000002

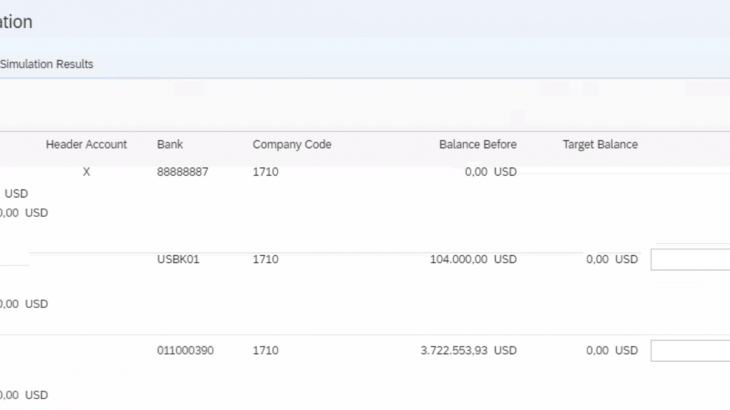

5.2.3 Perform Cash Concentration

Fiori App “Manage Cash Concentration”

From the above screens, you can notice that Bank Account 88888 is the header account and 1000001 and 33333 are subaccounts. From the simulation result, it is visible that Bank account 1000002 is also participating in the concentration process and its balance will be added to account 1000001. Therefore, account 100001 will have a balance of 104000 (34000+70000).

Once we click on save, the system will generate the cash concentration ID and the payment requests.

The payment requests can be paid via Make Bank Transfers (F0691) app or via Payment program F111.