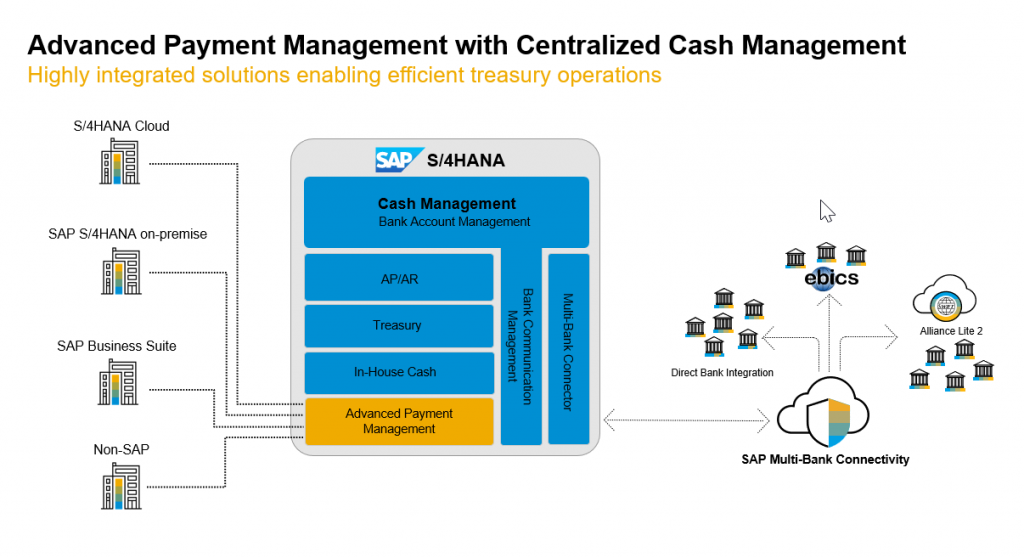

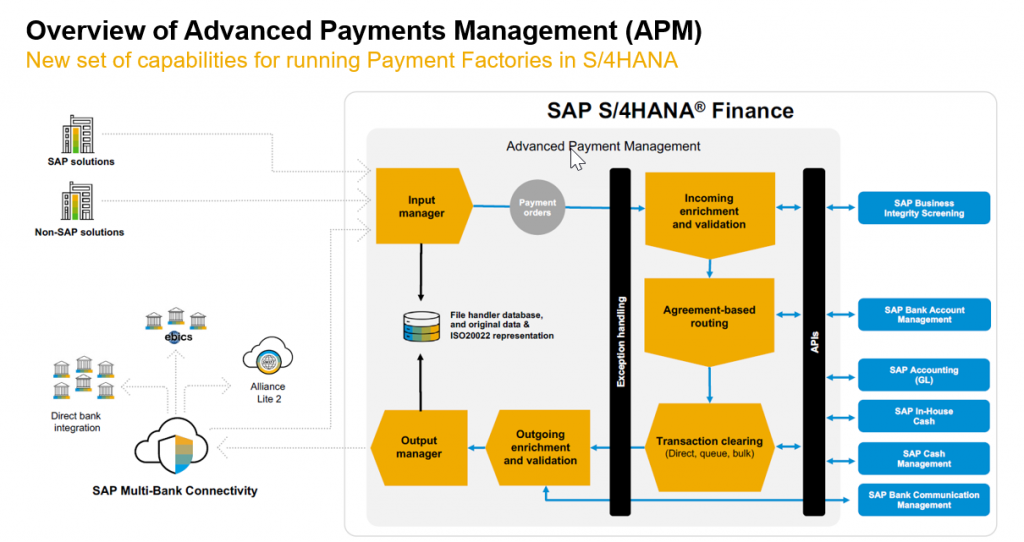

Advanced payment management allows you to centralize all payment activities of a corporate group. Advanced payment management supports five payment scenarios: Internal payments, payments ‘in name of’ with forwarding only, payments ‘in name of’ with routing optimization, payments ‘on behalf of’ and central incoming payments.

It integrates with other areas within SAP S/4HANA such as In- House Bank, In-House Cash, Cash Management, Bank Communication Management, Bank Account Management and General Ledger.

As organizations scale up, there is significant increase in payment volumes and hence need to automate, streamline, optimize the end-to-end payment process across the entire group. Headquarter need the centralization of the payment approval and monitoring for subsidiaries by using a single source of truth. They need the ability to handle different payment formats centrally and automate the routing of payments to different financial institutes.

The system uses Bank Account Management to determine the bank account to be used, triggers approval through Bank Communication Management and once approved creates the external medium for transmission to the bank using Multi Bank Connectivity.

SAP S/4HANA Finance for advanced payment management provides centralized payment factory to manage payments from various systems – SAP, non-SAP and manual payments.

In this blog we are majorly focusing on the scenario payments ‘in name of’ with forwarding only and its basic configuration.

In this scenario, we want to consume a file based payment instruction in advanced payment management and send it to the bank via Multi-Bank Connectivity.

In the following I will describe the available configuration which is used for this scenario as well as the master data which needs to be created to support the scenario.

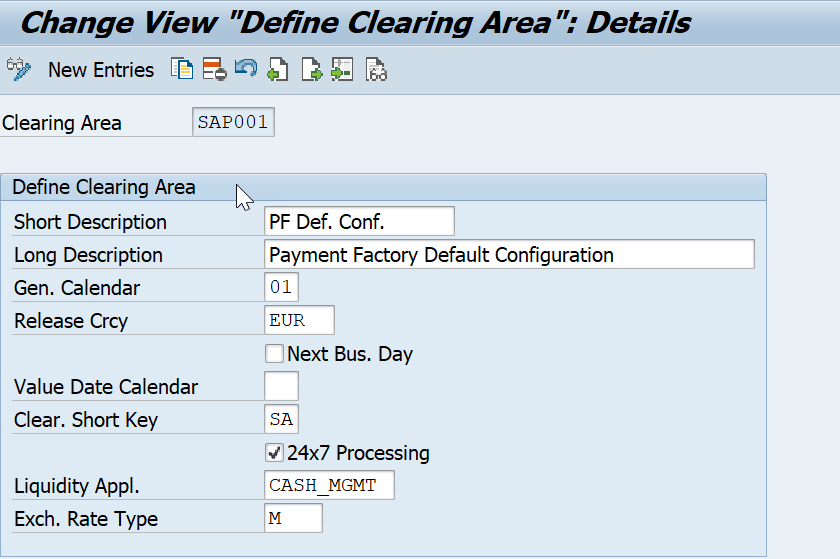

Define Clearing Areas

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–>Basic Configuration–>Organization–>Define Clearing Areas

Clearing areas act as an org object under the client level. Users working in one clearing area do not have access to data in other clearing areas. One clearing Area we can make work for multiple company codes with different currencies.

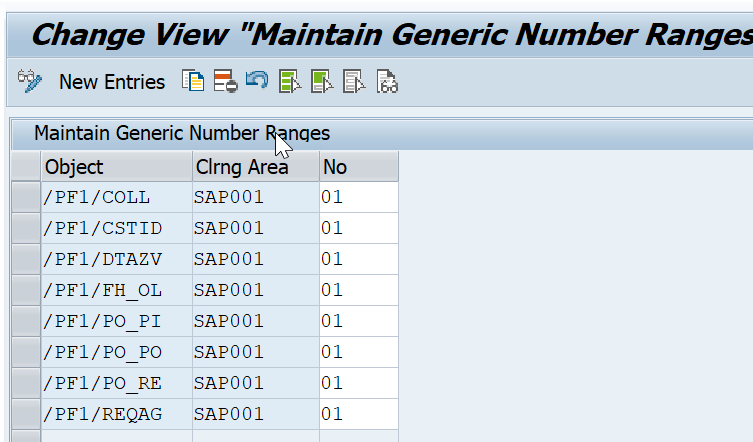

Maintain Generic Number Ranges

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–>Basic Configuration–> Maintain Generic Number Ranges

The number range numbers are assigned to diverse number range objects in advanced payment management. A number range object is uniquely identified by its name, and you can assign a number range number starting with 01 and an end value of 99.

With the number range numbers defined here you can customize the number ranges for the following objects:

- /PF1/COLL: Number Range Object for Collectors > Not used in the Project.

- /PF1/CSTID: Customer IDs for service level agreements > Not used in the Project.

- /PF1/FH_OL: Number Range Object List Number (Secondary Key)

- /PF1/PO_PI: Number range for Payment Transactions (Secondary Key)

- /PF1/PO_PO: Number range for Payment Order (Secondary Key)

- /PF1/PO_RE: Number range Object for Recalls > not used in this Project.

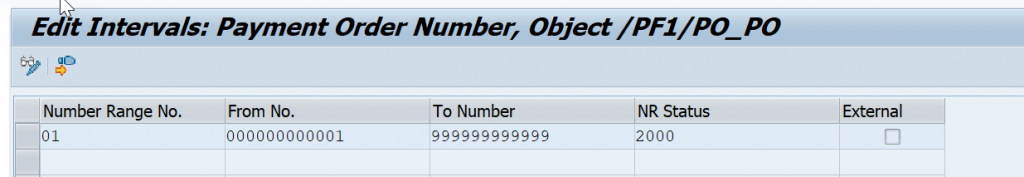

Maintain Number Ranges for Payment Orders

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> Business Objects–> Payment Order–> Maintain Number Ranges for Payment Orders

A clearing area always requires a payment order number range before payment orders can be processed in that clearing area. The payment order number is then populated in the Input Manager. You create a payment order number range for payment orders and define whether or not the payment order number is assigned internally by the system.

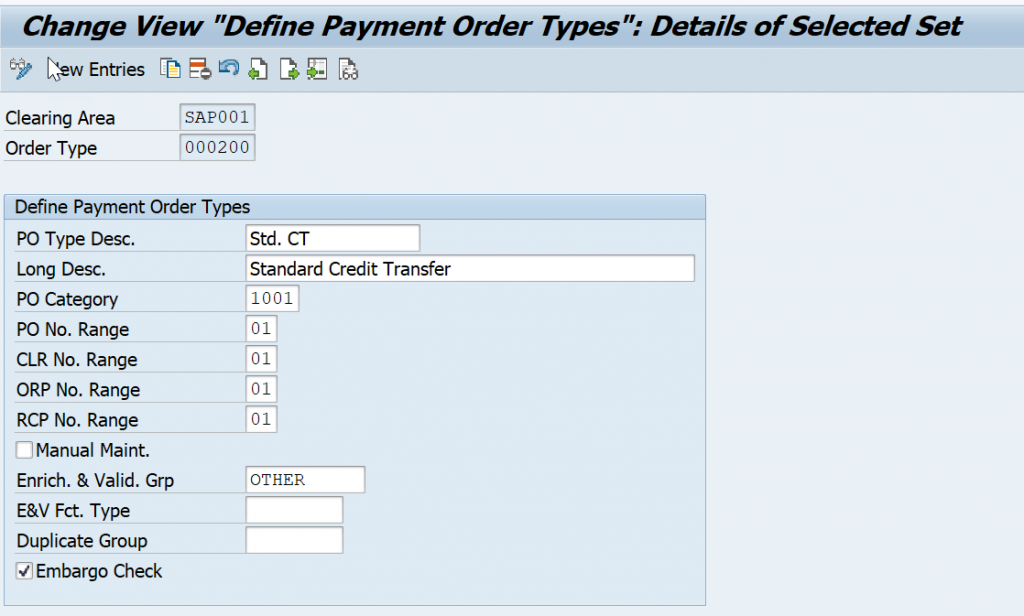

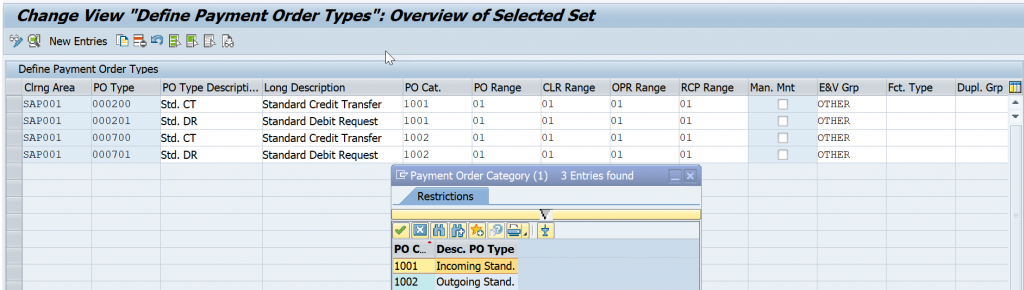

Define Payment Order Types

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> Business Objects–> Payment Order–> Define Payment Order Types

Payment order types are defined for both incoming and outgoing payment orders. Every payment order needs exactly one payment order type.

The payment order types that are defined here are assigned to incoming & outgoing payment orders by format converters.

The payment order tells the system what checks to carry out on the payment order and its components.

While payment order categories are delivered as part of advanced payment management, payment order types can be used as incoming or outgoing order.

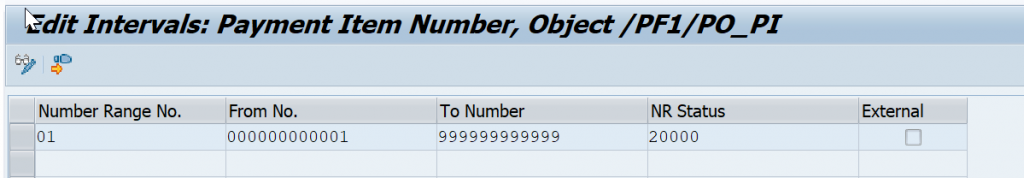

Maintain Number Ranges for Payment Items

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> Business Objects–> Payment Item–> Maintain Number Ranges for Payment Items

If the payment item numbers are assigned internally then they are assigned incrementally. Customizing allows you to set the lower and upper limits for a payment item number. The last number to be assigned is also visible in this activity.

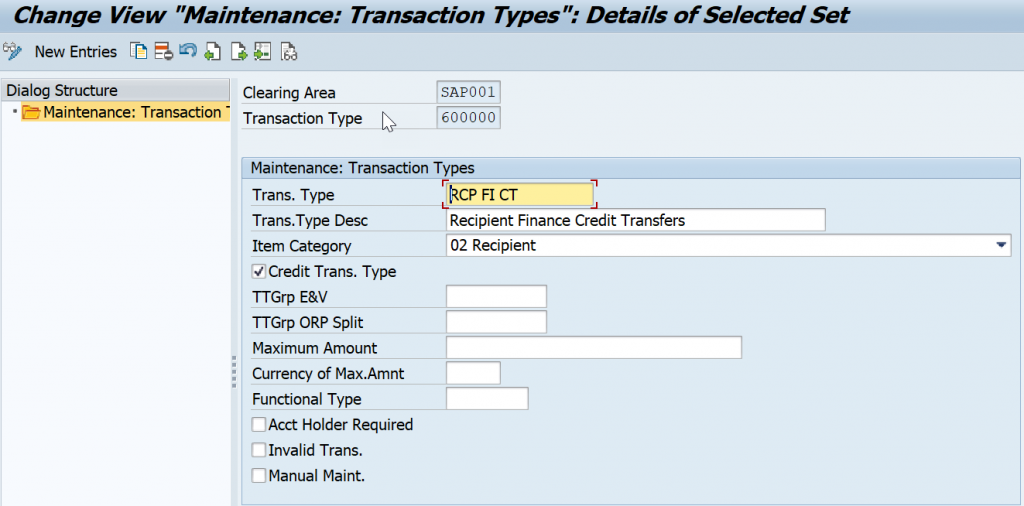

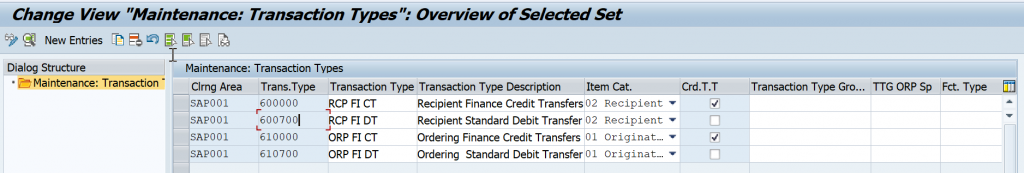

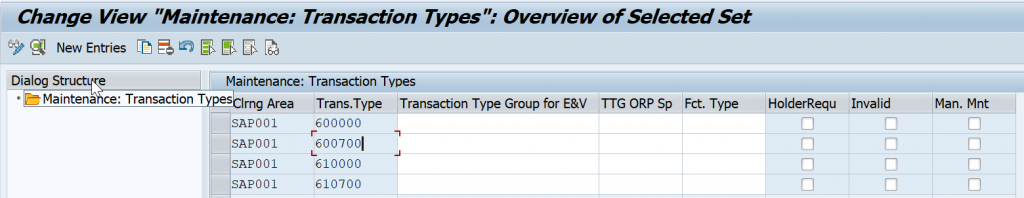

Define Transaction Types

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> Business Objects–> Payment Item–> Define Transaction Types

The transaction types are assigned attributes that determine the processing of payment items. They can determine whether the amount is a credit, or a debit and which validations should be carried out during posting.

- Originator: – An item posted to the party initiating the payment order. (Company Code)

- Recipient: – An item posted to the party receiving the payment. (Beneficiary Vendor/ Customer)

- Clearing: – A special category of payment item used for internal posting. During the clearing process, a clearing item is generated either when a payment batch is closed or when a single payment order is forwarded. For clearing batches, the clearing item is posted on the bank clearing (nostro) account. For internal batches, the clearing item is posted on the customer account.

- Turnover: – A special category of payment item that does not have an ordering party or recipient characteristics. Turnover items are usually generated by internal settlement systems, for example, when security transactions are handled or interest is calculated.

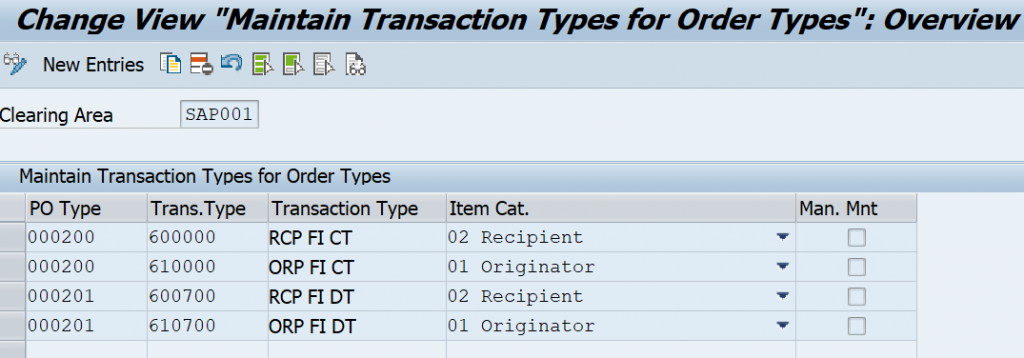

Assign Transaction Types to Order Types

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> Business Objects–>Payment Item–> Assign Transaction Types to Order Types

The relationship between payment order type and its allowed transaction types. The Order and Repair user interface uses this information to display allowed transaction types.

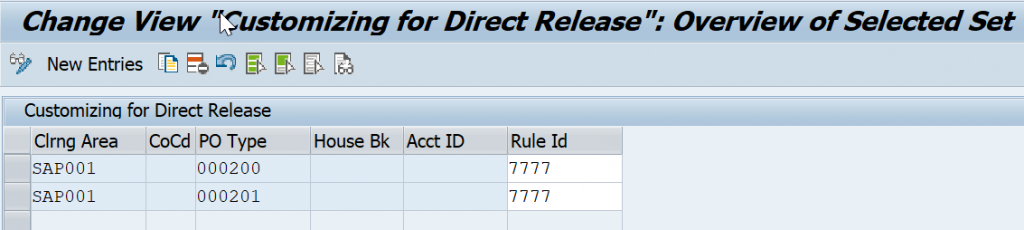

Define Rules for Bank Communication Management

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> External Interfaces–> Bank Communication Management (BCM)–> Define Rules for Bank Communication Management

Maintain the Bank Communication Management (BCM) rule IDs that are used in BCM workflow configuration for payments that are passed from advanced payment management. You can map it based on order type, Company Code, House bank & Account ID

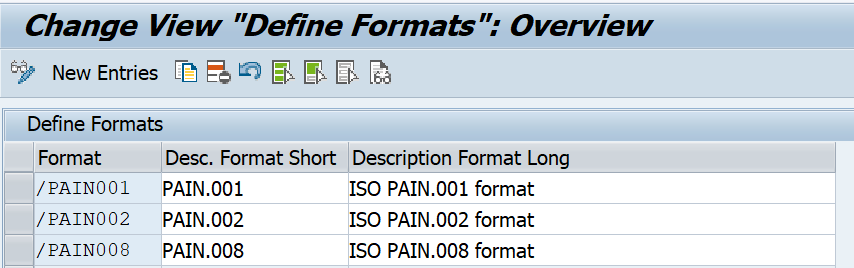

SetUp Converter

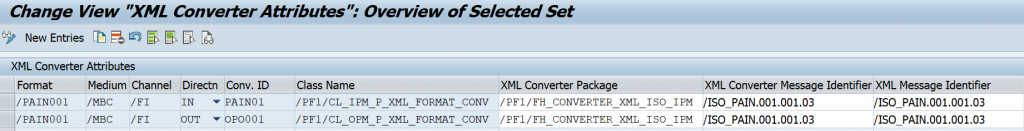

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> External Interfaces–> File Handler–> Basic Configuration–> Set Up Converter

Maintain the format in which data is passed into and out of advanced payment management. The format describes the structure of the fields and records of the payment objects that are used in advanced payment management.

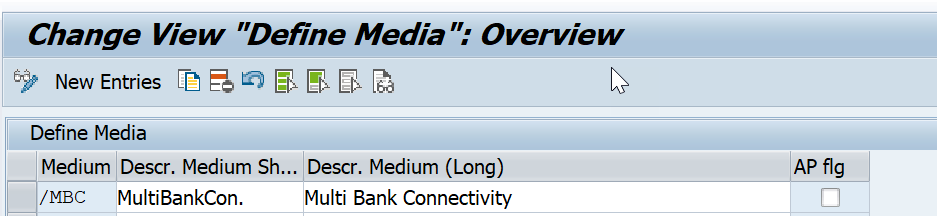

Define Media

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> External Interfaces–> File Handler–> Basic Configuration–> Define Media

You maintain the medium used to deliver data to and from advanced payment management. The medium along with the channel and the format defines a converter.

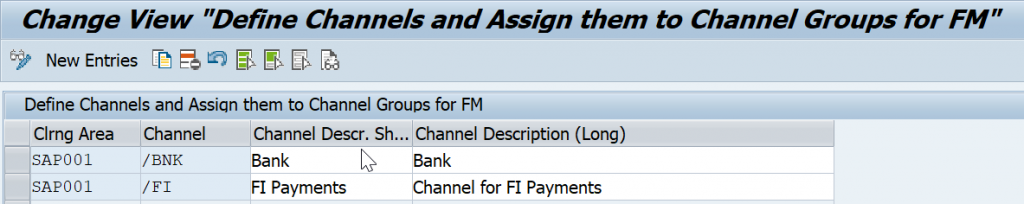

Define Channels

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> File Handler–> Basic Configuration–>Define Channels

The channel used to deliver data to advanced payment management

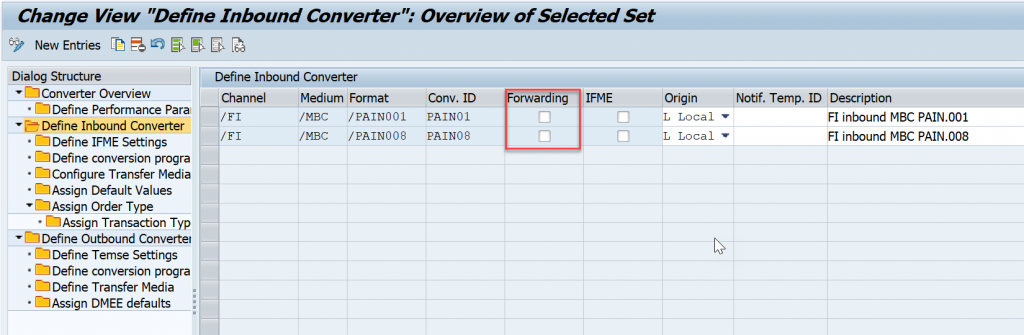

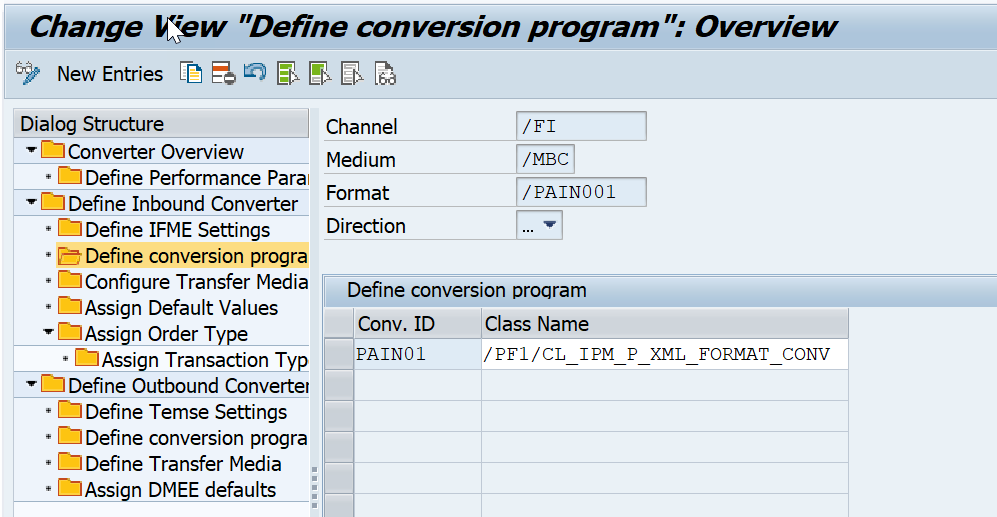

SPRO–>Financial Supply Chain Management–>Advanced Payment Management –>External Interfaces–> File Handler–> Basic Configuration–> Define Converter(new)

Define Inbound Converter

A converter is represented by the combination of 4 attributes. Format, medium, channel and direction are linked with a conversion program, which is responsible for interpreting the data and translating it into the required target data structure or file format.

If the file to be imported is a standard XML file, we would use the standard inbound conversion of the XML conversion framework. Its class is /PF1/CL_IPM_P_XML_FORMAT_CONV, however you do not have to enter the class, it would be derived automatically.

If Schema and tag validation was already done in your source system and if you want forward this format without any change or validation than it is recommended to use the flag ‘Forwarding’. it is recommended to use the class /PF1/CL_IPM_FORWARD_PAIN1. The partial reaction is not possible always processing happen at file level.

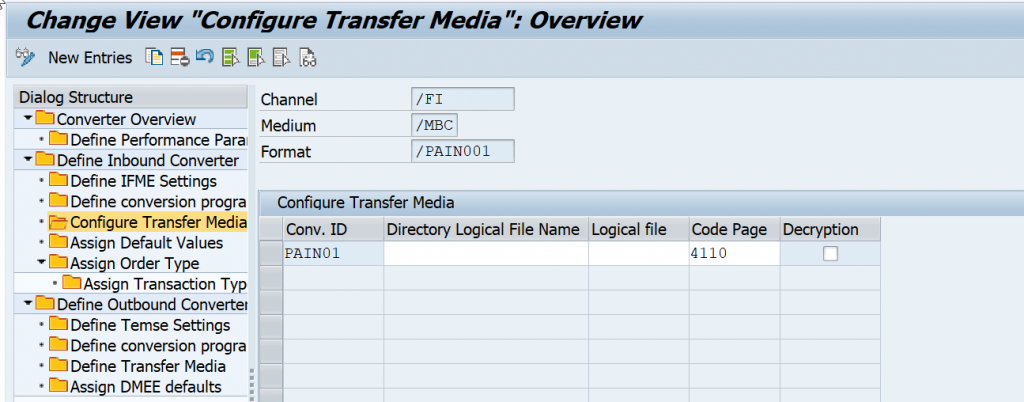

If you are using the Multi-Bank Connectivity (MBC) local routing functionality than it not required to configure the Directory logical file Name & Logical File ( in this scenario we are using the MBC local routing)

Note:- If you are not using the MBC local routing functionality than it is mandatory to configure the Directory logical file Name & Logical File.

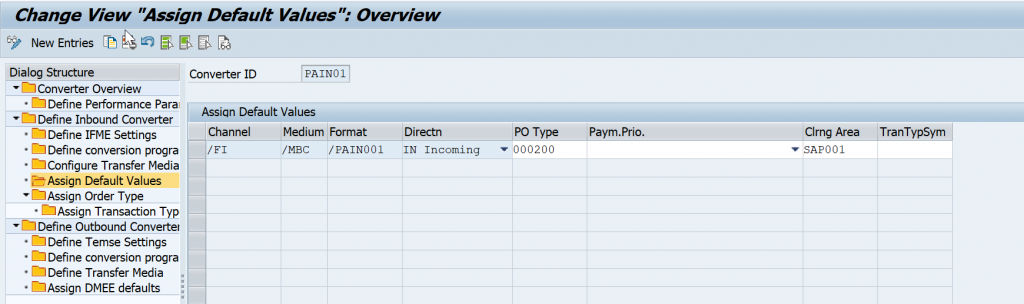

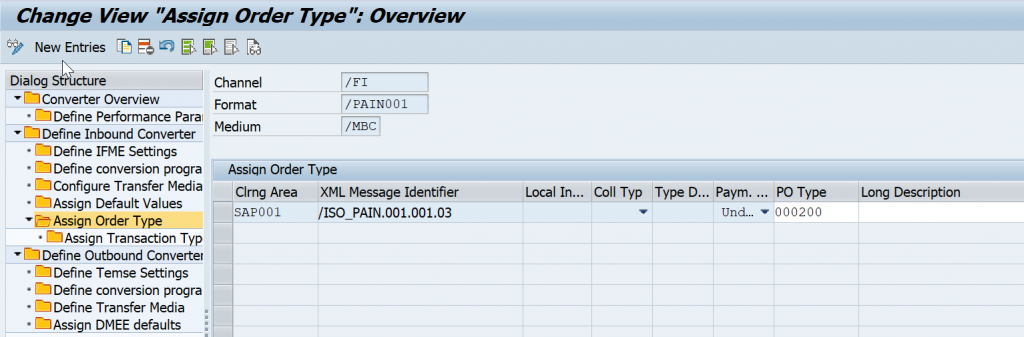

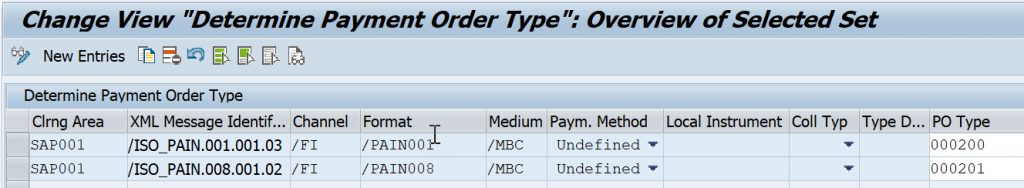

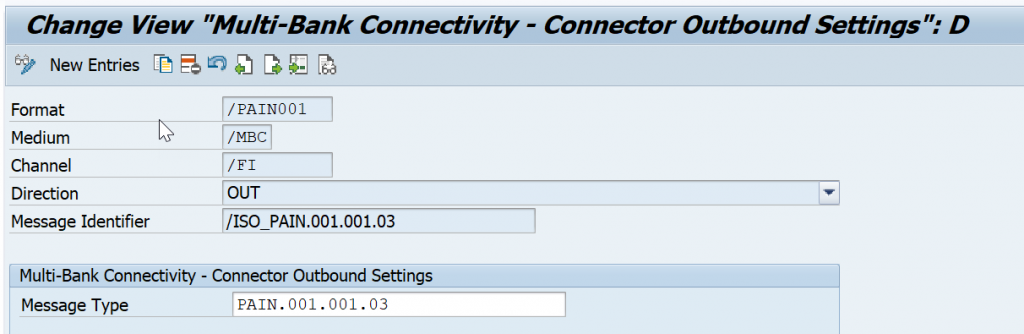

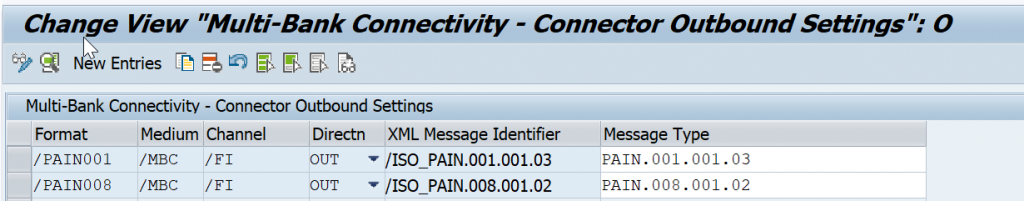

For the outgoing Payments I am using the order type”000200” for Clearing area SAP001 in below screen shot which I configure.

For the outgoing Payments I am using the XML Message Identifier as “/ISO_PAIN.001.001.03” for order type “000200” in below screen shot which I configure.

PAIN.001.001.03 Message Type Inbound Handler with Help of MBC and F110 Automatic payment program

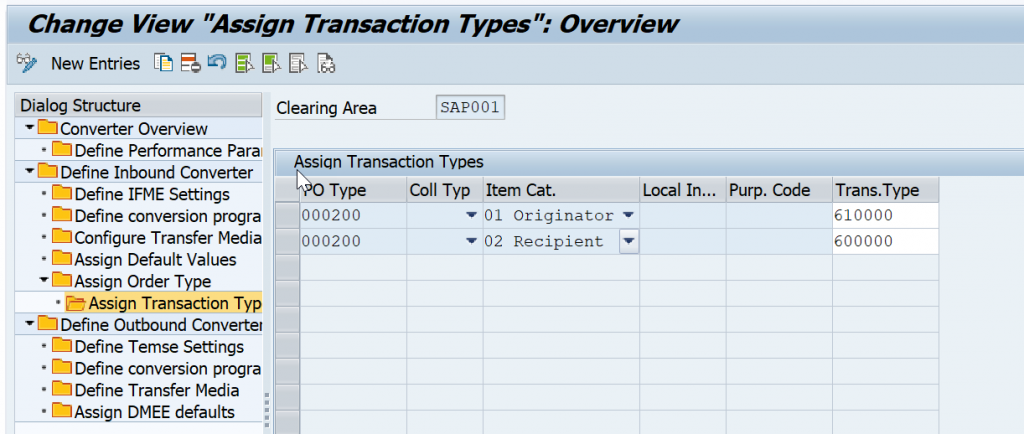

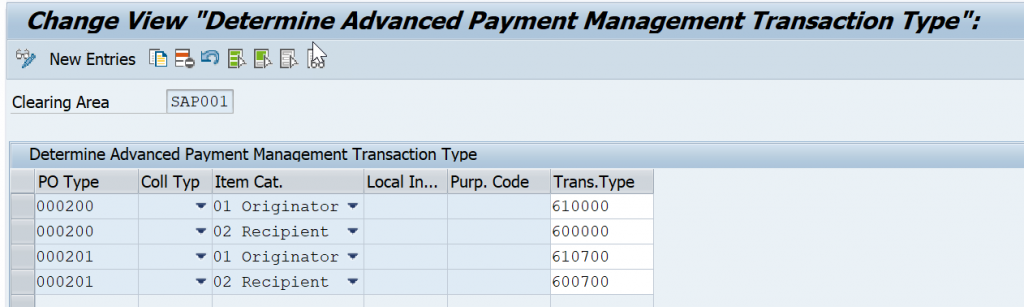

We are assigning the Incoming order type is assigned to Converter ID as per the above Screen Shot. The Order type we are assigned it to Transaction type at clearing area level.

- Originator: – An item posted to the party initiating the payment order. (Company Code)

- Recipient: – An item posted to the party receiving the payment. (Beneficiary Vendor/ Customer)

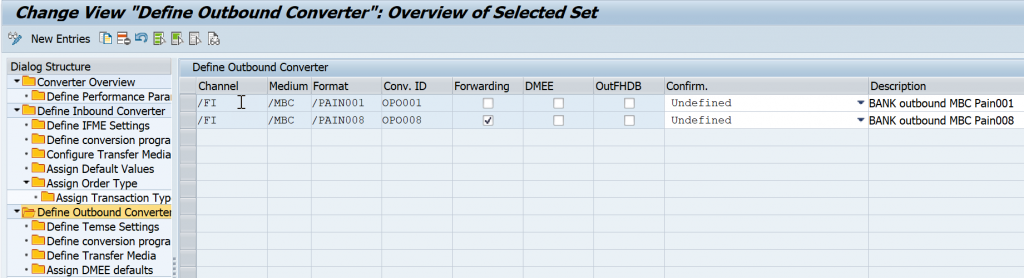

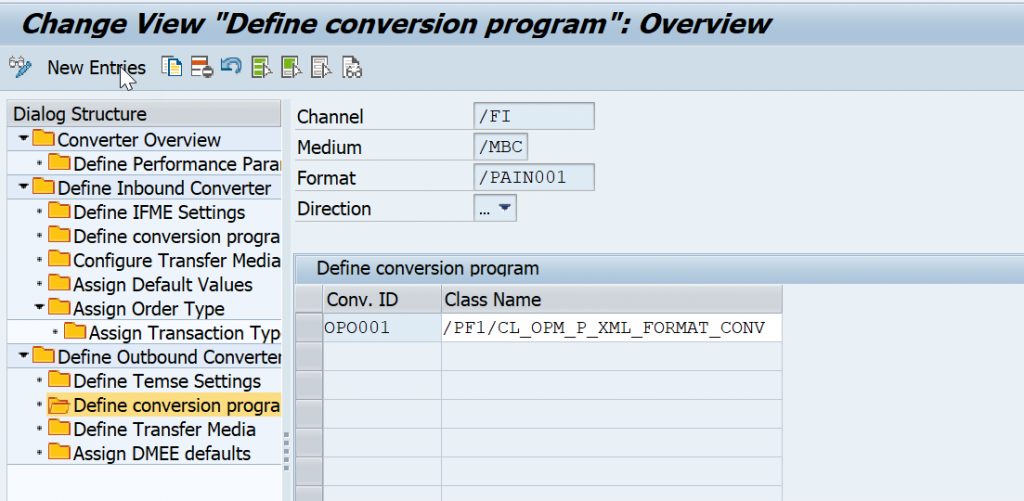

Define Outbound Converter

A converter is represented by the combination of 4 attributes. Format, medium, channel and direction are linked with a conversion program, which is responsible for interpreting the data and translating it into the required target data structure or file format

the converters map the data received from the source system to advanced payment management meta format in the Output Manager (OPM)

If we are using XML conversion framework Converter class for outbound file based conversion it is standard class which we use the configuration /PF1/CL_OPM_P_XML_FORMAT_CONV,

If Schema and tag validates already done in your source system and if you want forward same format without any change or validation than it is recommended to use the Class in the configuration /PF1/CL_OPM_FILE_FORWARD_CONV

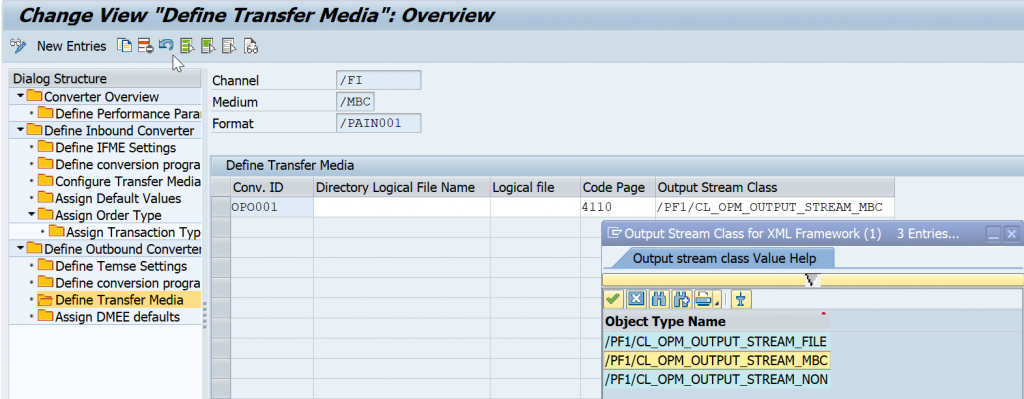

we are using the Multi-Bank Connectivity (MBC) than it not required to configure the Directory logical file Name & Logical File ( in this scenario we are using the MBC local routing)

we using the Multi-Bank Connectivity (MBC) than it is mandatory to configure the Class “/PF1/CL_OPM_OUTPUT_STREAM_MBC” or it will not create out file which we needs send it bank.

Note:- If you are not using the MBC functionality than it is mandatory to configure the Directory logical file Name & Logical File. It recommended to configure the class /PF1/CL_OPM_OUTPUT_STREAM_FILE, if you not configured also by default it will pick up the class as /PF1/CL_OPM_OUTPUT_STREAM_FILE

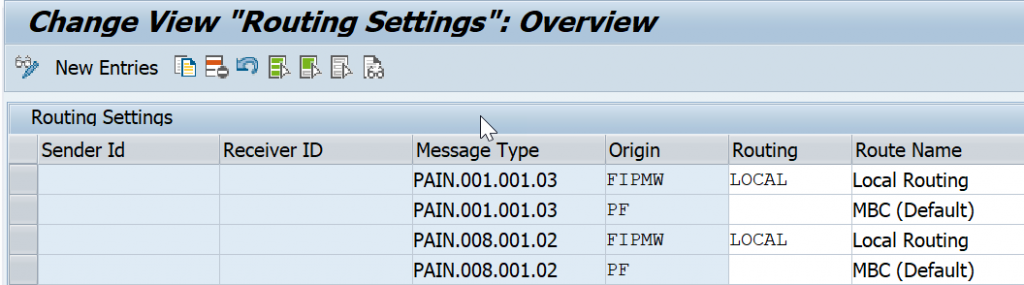

Maintain Routing Settings for Outbound Messages

SPRO–> Multi-Bank Connectivity Connector–> Routing and Connectivity–> Maintain Routing Settings for Outbound Messages

In case of local routing, an outgoing message is not sent to SAP Multi-Bank Connectivity. Instead, a new inbound message is created using the outgoing message. The new inbound message is handed over to the Connector for SAP Multi-Bank Connectivity for inbound processing.

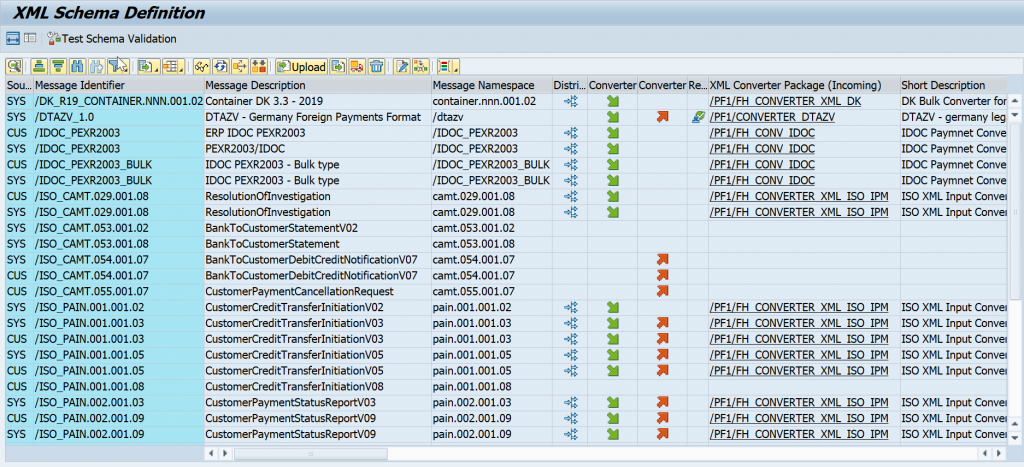

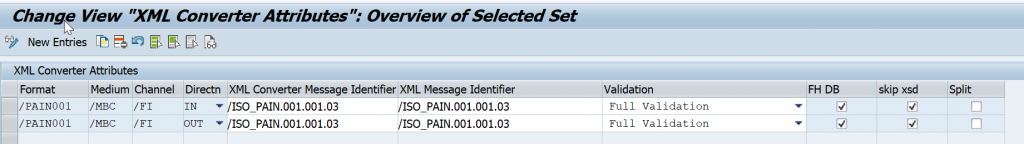

Set Up XML Schema Validation

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> External Interfaces–> File Handler–> XML Framework–> Set Up XML Schema Validation

The XML schema definitions can be used in the IPM/OPM XML Format Converters.

The XML schemas could be used as follows:

- As a basis template for an XML converter implementation. For more information, see Message Identifier for an XML Converter.

- As a rule set for an individual schema validation of XML files. For more information, see Identifier of an XML message that defines an XML schema definition (XSD).

In the standard system, some standard XML schema definitions are available for implemented converters. If required, you can update these schemas with adjusted versions. The customizing table is protected against SAP updates. SAP is allowed to insert new entries only.

- Choose Upload to upload a new XSD file from your local PC.

- The following data has been entered to have the ISO_PAIN.001.003.03 in the system available:

- Choose Upload XSD File to store this schema definition in the Customizing table.

- Depending on the standard client transport settings, you may need to create a transport request.

The Customizing transaction enables you to display each schema definition in a detail tree view with the different types of validations (for example, patterns or digits) for each node.

Test the XML schema validation on individual XML files by choosing the Test Schema Validation button.

To replace individual invalid XML values and to control errors from the XML schema validation more flexibly, you can use the BAdI: Replacement of Invalid XML Values During Read Access.

Define XML Settings for Format Converter

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Payment Processing–> External Interfaces–> File Handler–> XML Framework–> Define XML Settings for Format Converter

the converter implementation from the settings in this Customizing activity. You can either directly assign a specific converter implementation or specify a converter package. Converter packages can provide automatic converter implementation derivation by using the BAdIs listed at the end of this section.

You need to specify the correct converter implementation for output converters. You assign the general XML output converter /PF 1/CL_OPM_P_XML_FORMAT_CONV for your format converter regardless of the XML format. This activity enables you to inform Output Manager of the type of XML format that has to be created.

You can also use the following BAdIs to overrule the customizing settings:

- BAdI: Derivation of Message ID for XML Input Converter

- BAdI: Derivation of Message ID for XML Output Converter

- /PF1/BADI_FH_XML_MSG_IDENT_OPM

- /PF1/BADI_FH_XML_CONVERTER

- /PF1/BADIIMPL_FH_XML_IPM_ISO

- /PF1/BADIIMPL_FH_XML_OPM_ISO

- /PF1/BADIIMP_FH_SWIFT_IPM

- /PF1/BADIIMP_FH_SWIFT_OPM

- /PF1/BADI_BNK_WF_INTEGRATION

- /PF1/BADI_IMPL_BP_DEFAULT

- /PF1/BADIIMPL_OPO_PROCESS_BCM

- /PF1/BADIMPL_PO_XML_MAP_ISO

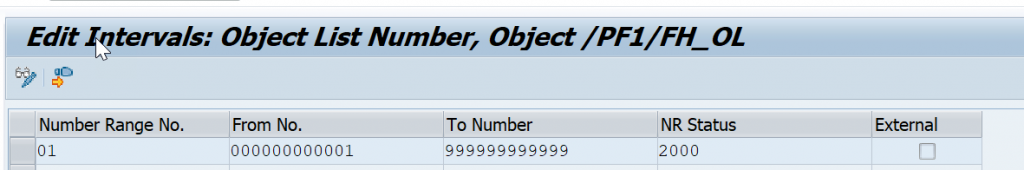

Maintain Number Ranges for Object List

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> File Handler–> Basic Configuration–>Maintain Number Ranges for Object List

A converter that converts the incoming payment order information into business objects of advanced payment management is determined based on format, medium and channel. One business object that is created is the business object “Object List”

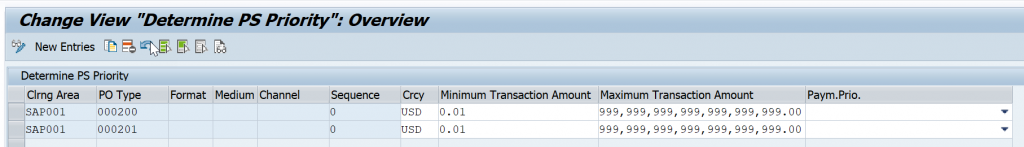

Determine Payment Order Priorities

SPRO–>Financial Supply Chain Management–>Advanced Payment Management –> External Interfaces–> Format Specific Configuration–> ISO20022–> Determine Payment Order Priorities

The determination of the advanced payment management internal priority of payment orders. This information controls, amongst others, the processing frequency and the frequency in which the order status is changed. The priority is determined and assigned to the payment order. In the case the priority cannot be determined for e.g. the respective message field is not filled (optional) a default priority is assigned.

Determine Payment Order Types

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> Format Specific Configuration–> ISO20022–> Determine Payment Order Types

the determination of the internal payment order type. The system uses this control information for certain validation and processing throughout advanced payment management. You define this information in the payment order. The combination of message type and original message type allows the system to distinguish uniquely between credit transfers and direct debit and between -bank-to- bank R-messages (reject/return).

Determine Item Transaction Type

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> Format Specific Configuration–> ISO20022–>Determine Item Transaction Type

the system determines the internal transaction type. You define the transaction type for the payment item in customizing (see below). This control information is used for various validation and processing steps throughout the system.

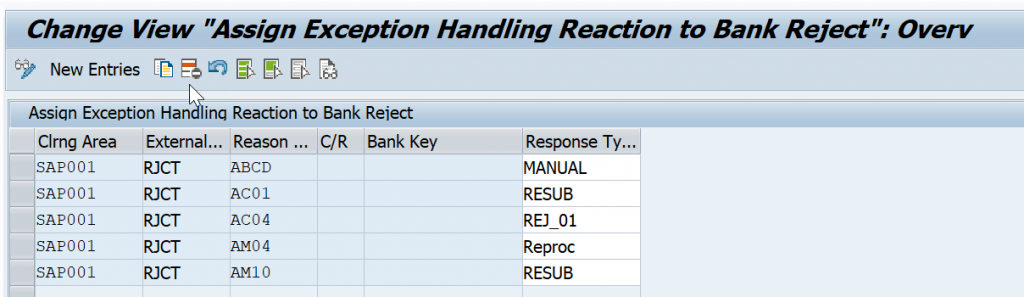

Assign Exception Handling Reaction to Bank Reject

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> File Handler–> External Status–>Assign Exception Handling Reaction to Bank Reject

he system will use the most specific (bank specific) entry. If no matching entry for the bank is available, the generic entry without bank identifier will be applied.

If no specific reaction type is defined, the ‘ Define Default Reaction Types’ or Master data configuration will be used for the standard error code ‘Bank Reject(002010)’.

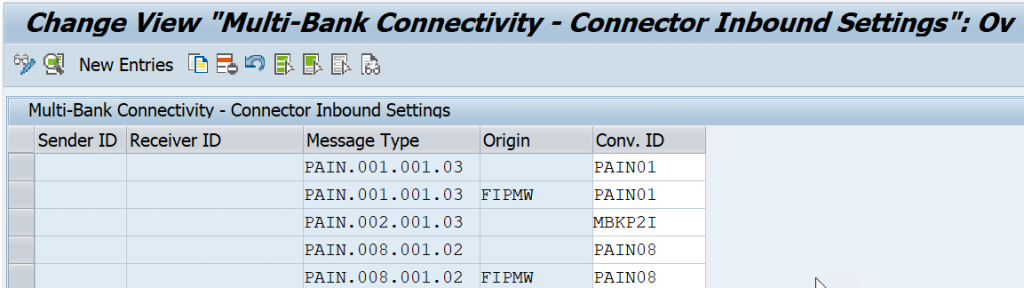

Maintain Multi-Bank Connectivity Connector Inbound Settings

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–>External Interfaces–> File Handler–> Multi-Bank Connectivity Connector Integration–> Maintain Multi-Bank Connectivity Connector Inbound Settings

Maintain inbound settings for Multi-Bank Connectivity (MBC) messages received via the Multi-Bank Connectivity Connector. We can configure the Convertor ID based on Sender ID, Receiver ID, Message type and origin ID.

With the help of MBC Local Routing functionality once we ran F110, the XML will be routed with help MBC and handed over to APM

Maintain Multi-Bank Connectivity Connector Outbound Settings

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> External Interfaces–> File Handler–> Multi-Bank Connectivity Connector Integration–> Maintain Multi-Bank Connectivity Connector Outbound Settings

the outbound settings for sending messages via the Multi-Bank Connectivity Connector to Multi-Bank Connectivity (tenant).

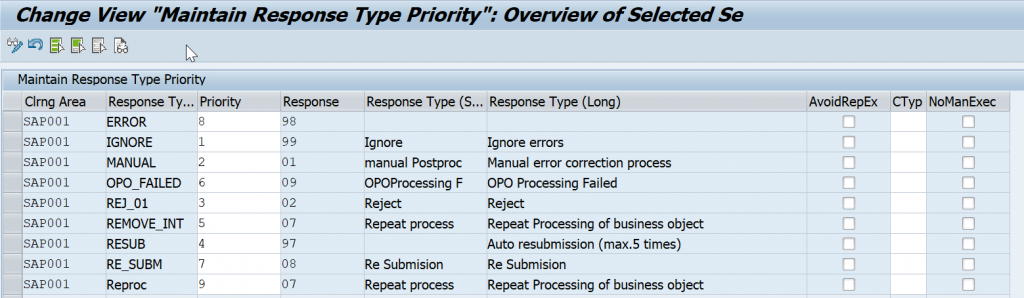

Exception Handling

SPRO–>Financial Supply Chain Management–>Advanced Payment Management–> Exception Handling

the priorities of all existing response types. The response types, regardless of the group, are listed with their respective response type groups in number format and a short and long text description.

Only the response type priority is set in this activity. You do not create or modify any existing information regarding a response type or a response type group.

you can create response types for rejection of payment orders and/or payment items. You assign an existing return reason and a final response type to the new response types.

You can use the dropdown box in the Partial column to specify whether the payment orders are to be rejected in full, or whether only incorrect items are to be rejected, and processing is to continue. If you do not specify a value in this column, the system rejects the payment order in full. You can also specify the correspondence type required in each case.

Payments are running into erroneous situations based on various reasons. Instead of pushing these payments back to the local subsidiary systems the solution allows to fix these errors in a central place, either manually or automatically.

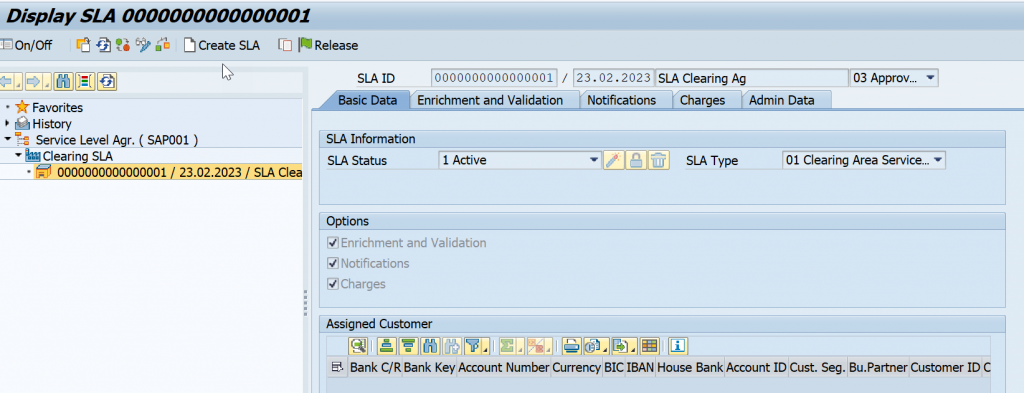

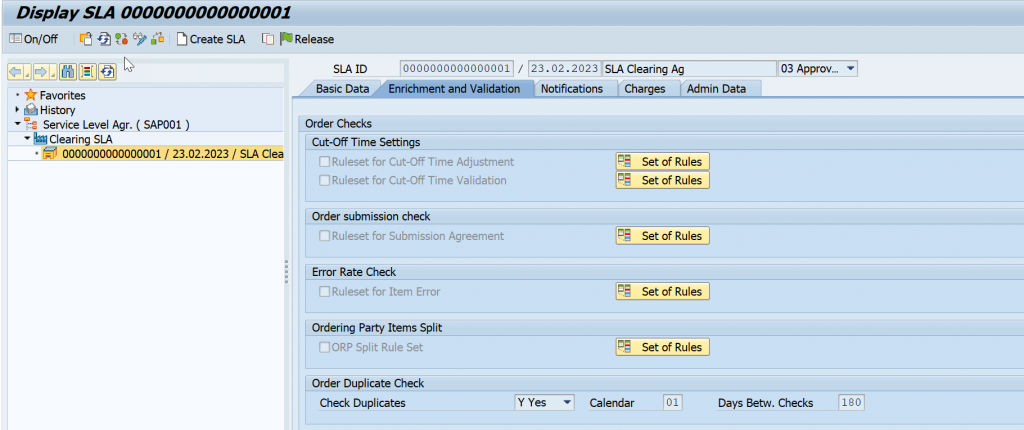

Service Level Agreement

SAP Menu–>Accounting–> Financial Supply Chain Management–> Advanced Payment Management–> Master Data–> Service Level Agreement

Displays options for Enrichment and Validation, Notifications and Charges for which you can define set of rules and restrictions in detail. Mark the relevant checkboxes in the Options section. The corresponding tab pages will be displayed.

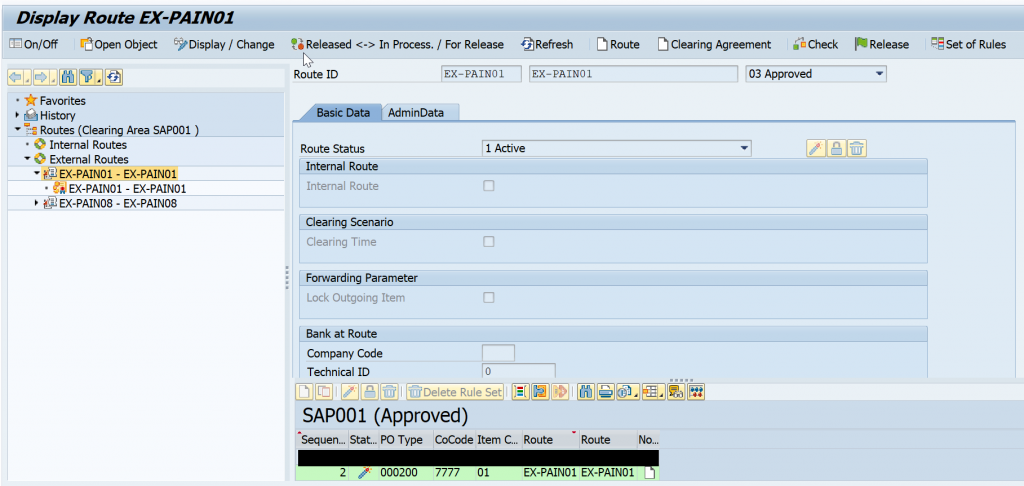

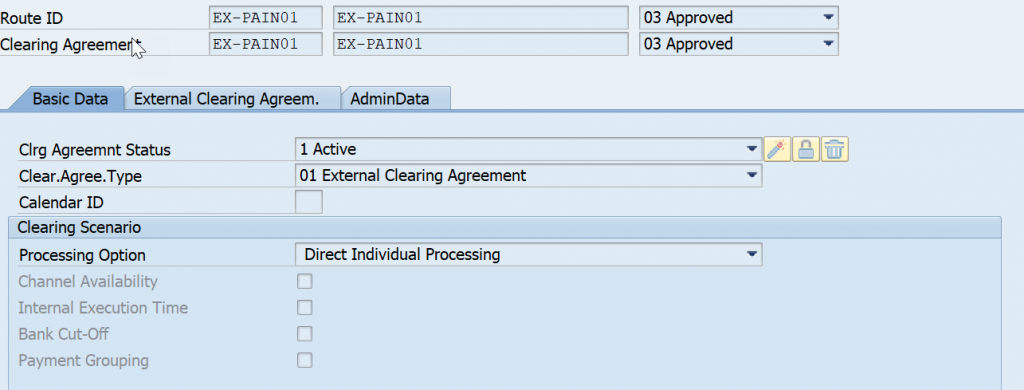

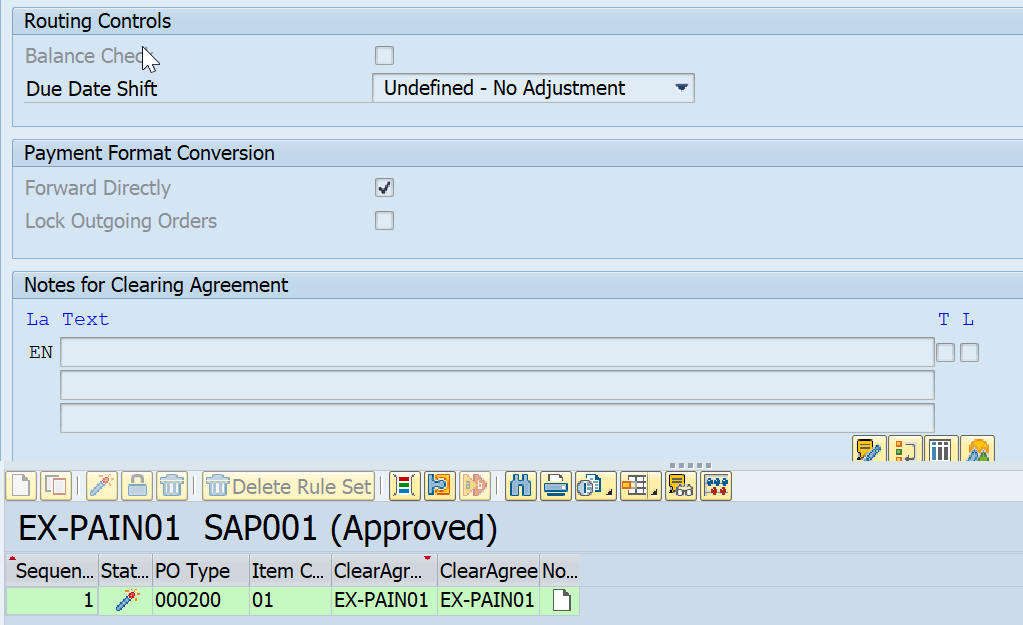

Routing Objects

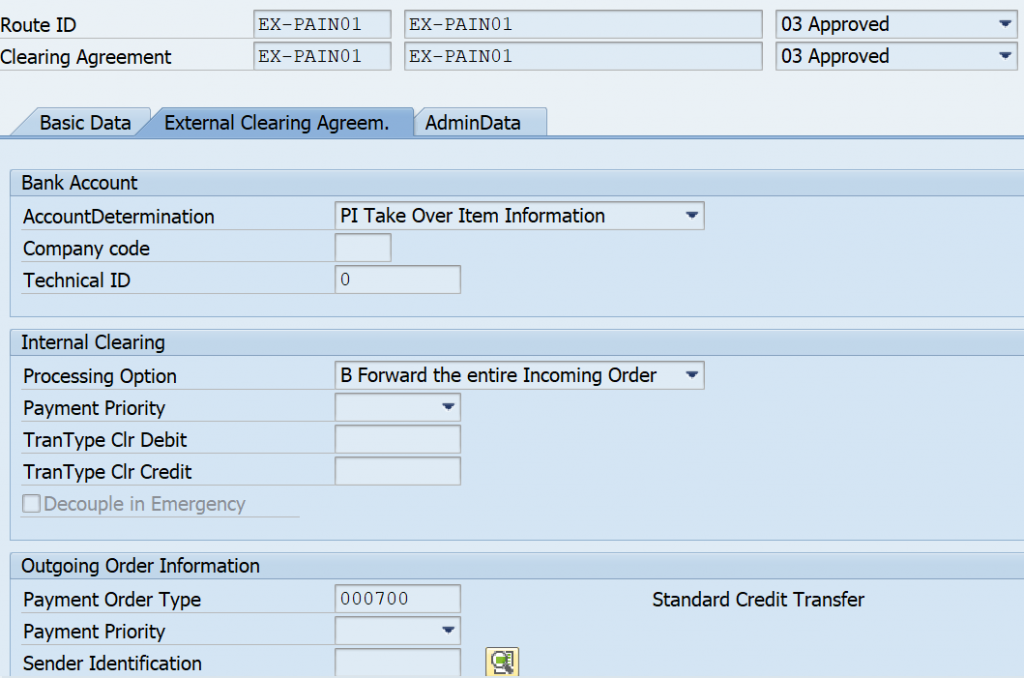

SAP Menu–> Accounting–> Financial Supply Chain Management–> Advanced Payment Management–> Master Data–> Routing Objects

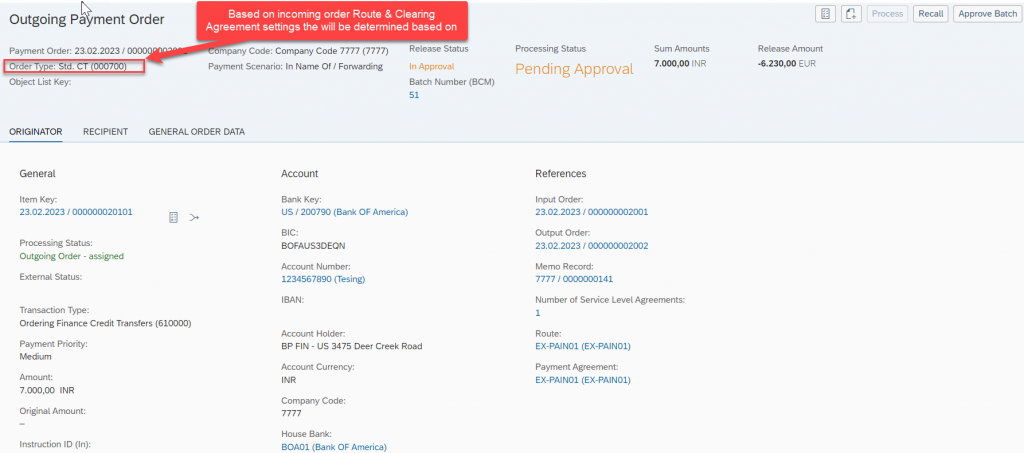

Based on the predefined Business rules such as Incoming order type, Bank Key, Account Number and originator the Route and clearing agreement it will be identified based on clearing area .

We can use all attributes of a payment like amount, currency, country, payment type, priority and additional attributes like time, % distribution of payments

Define payment routing based on business rules (master data)

Route by all attributes of a payment and several special dimensions, e.g.

- Cut-off times

- Percentage of business

- Beneficiary bank

- Available liquidity

- Adherence to due date

- Transaction Currency

- Payment Scheme compatibility

- Amount limits

- Payment Type

Perform rerouting and regrouping of payments

Link payment formats, cut-off times, bank account details, bank clearing account, etc. in one place with central governance and approval processes

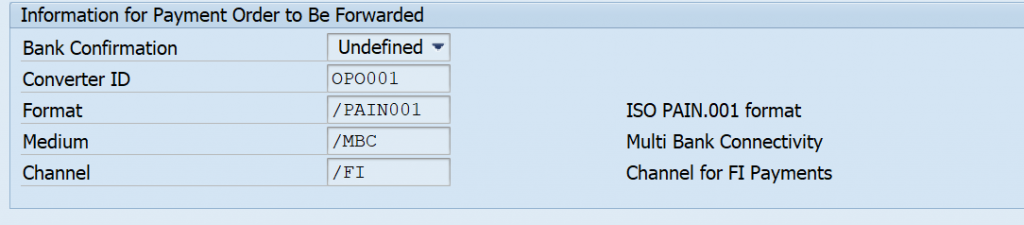

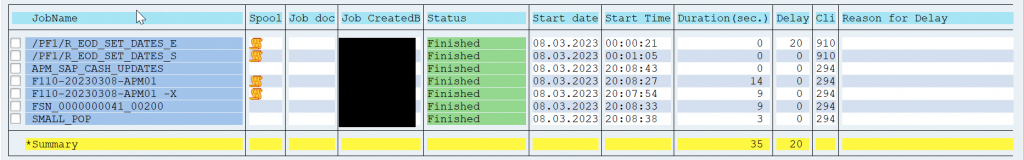

End user: Run Automatic Payment – F110

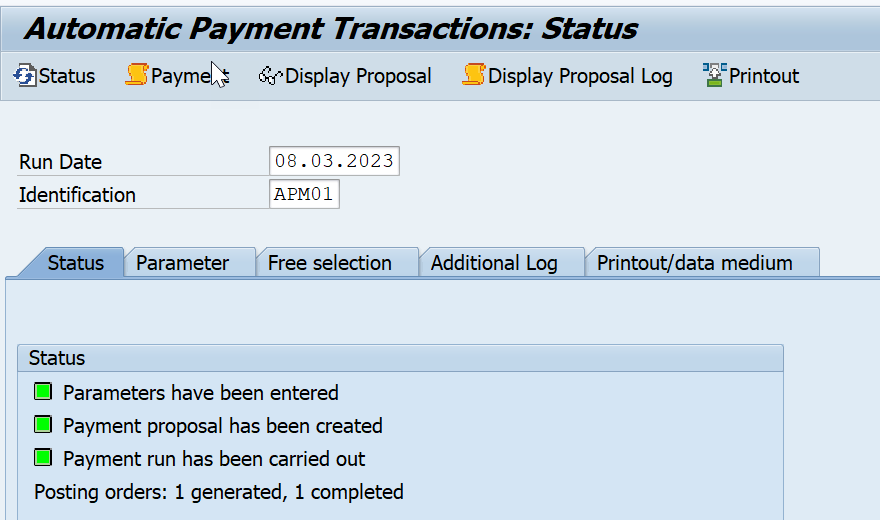

Apart from the Payment run job, MBC FSN job got tiggered automatically and the Small_POP job for the APM file import.

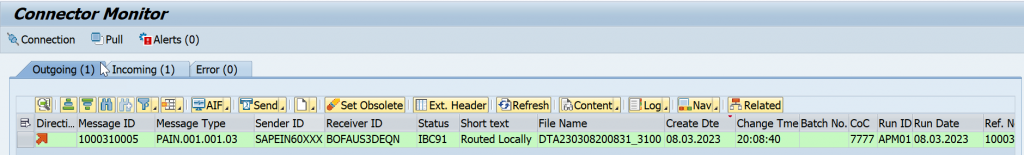

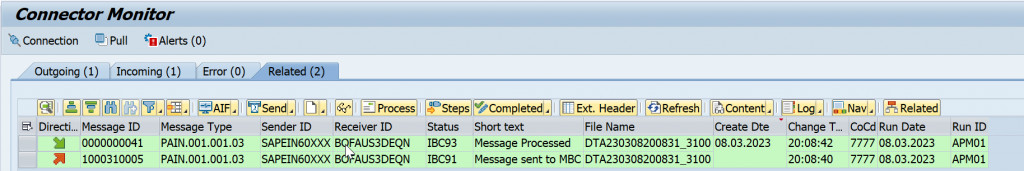

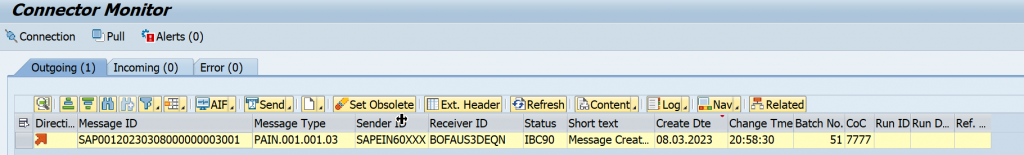

SAP Menu–> Connector for Multi-Bank Connectivity–> /BSNAGT/MONITOR – Connector Monitor

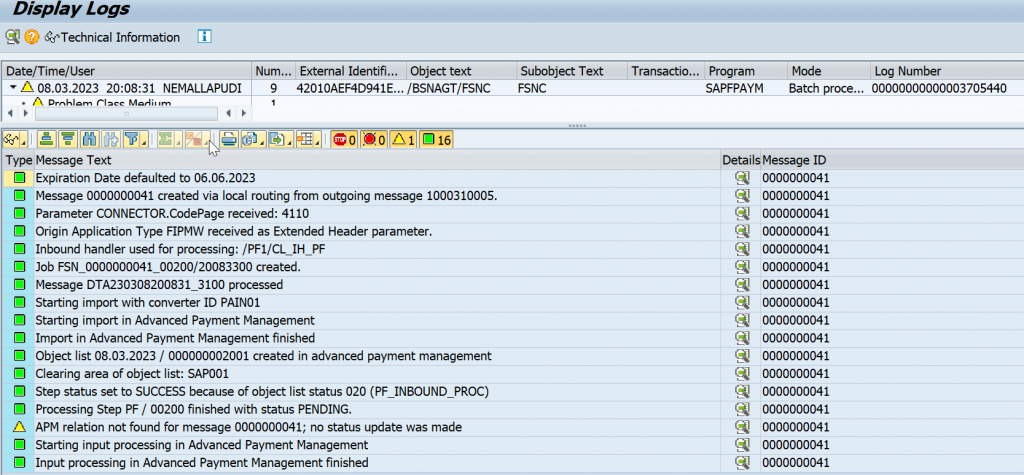

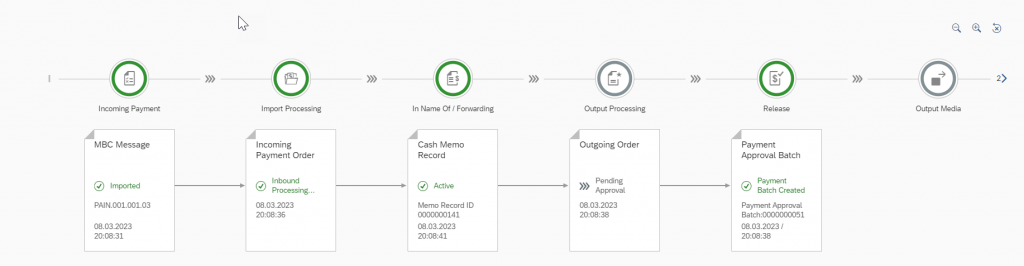

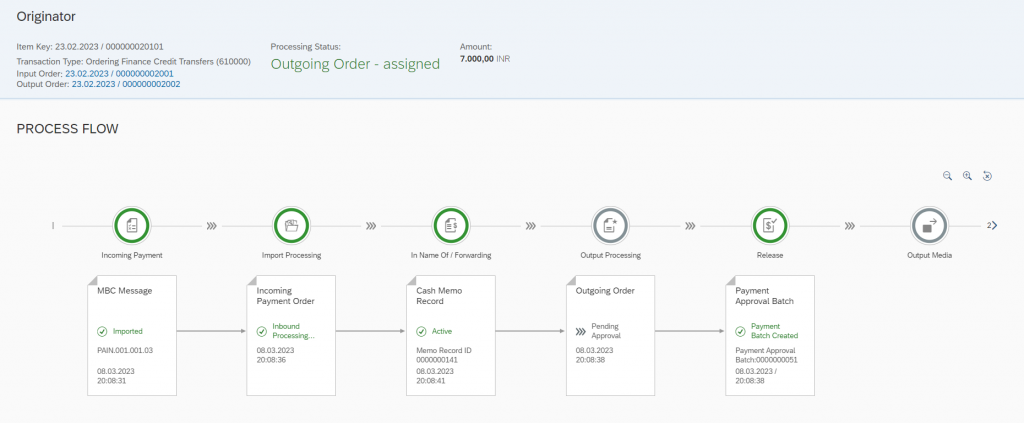

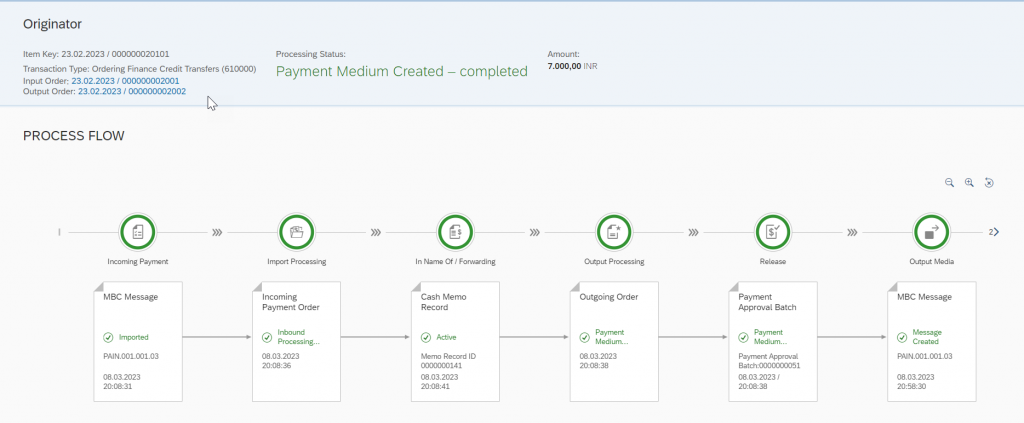

In the below screen shots it has been observed that file has not set out it has been locally routed and handed over to APM

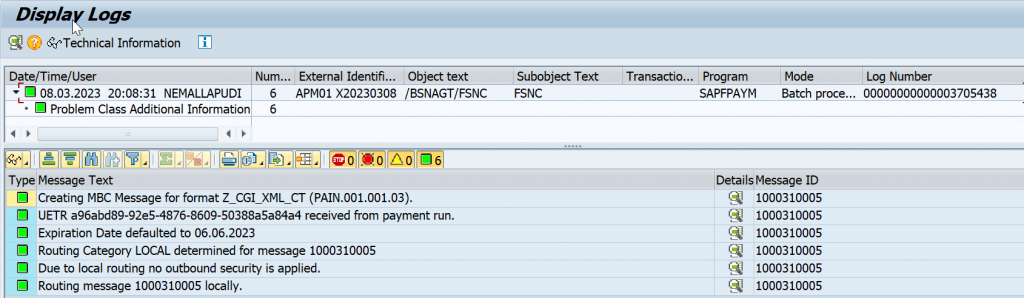

Loge Represents message has been locally routed

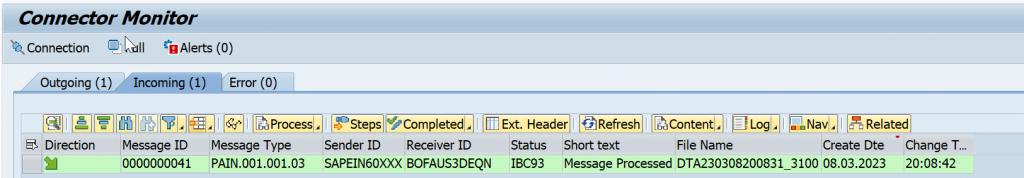

When the file is local routed it will show on incoming side

Loge Represents file has been handed over to APM

In the relation ship tab you see the both incoming and out going orders

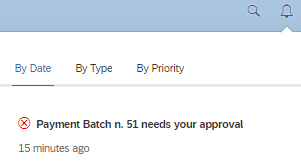

In the Fiori Notifications you observe the APM batch approval notification which has to be approved

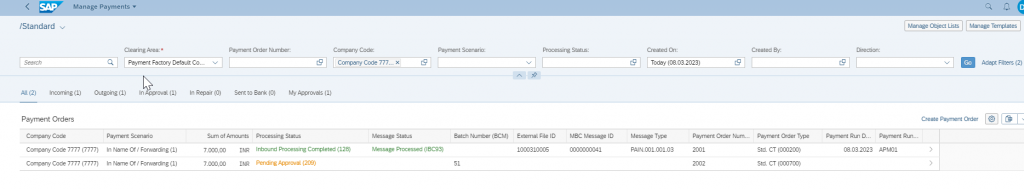

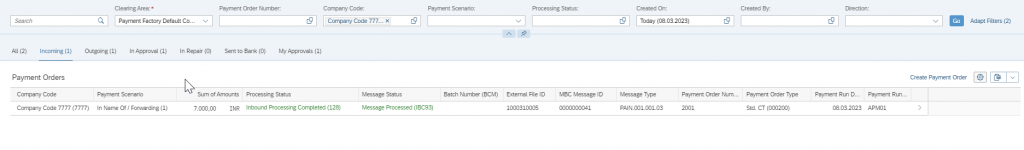

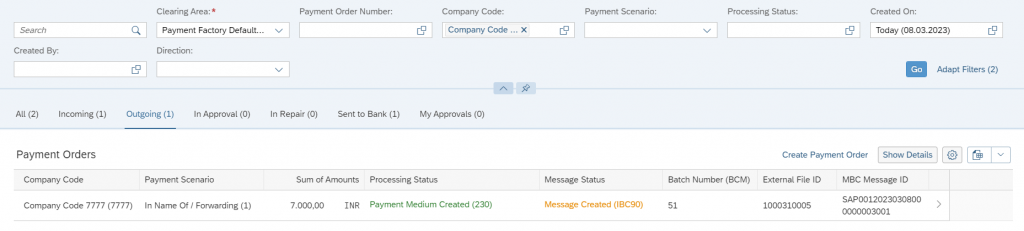

Got the APM (Advanced Payment Management APP’s and select the Manage Payment)

Based on the Selection it is displaying two orders which represents incoming order and Outgoing order based on the

Incoming order is getting created based on MBC Local routing based which file has been handed over to APM

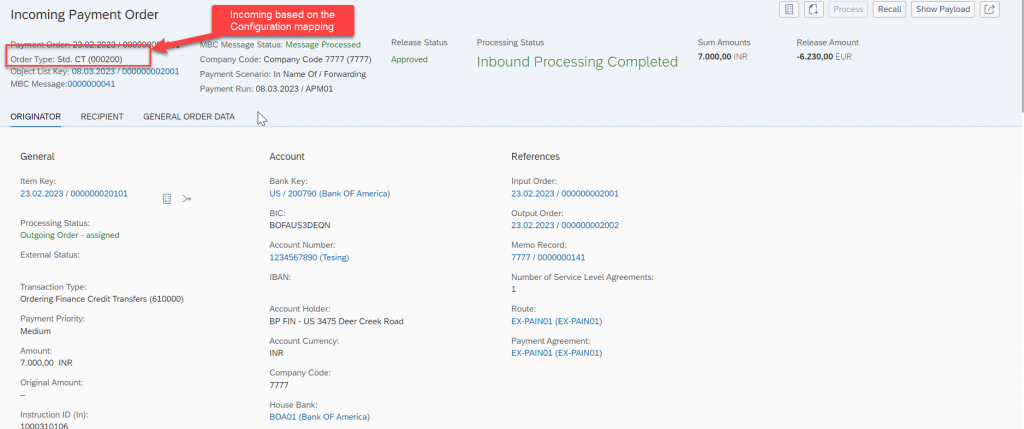

For Each outgoing order it has three Segments Originator, Recipient & General Order Data

Originator: – Sending Company code information , Send bank Account Information, Service level Agreements, route, Clearing Agreements & Process flows

Recipient: – Beneficiary Bank Account details, EndtoEndID , Service level Agreements, route, Clearing Agreements & Process flows

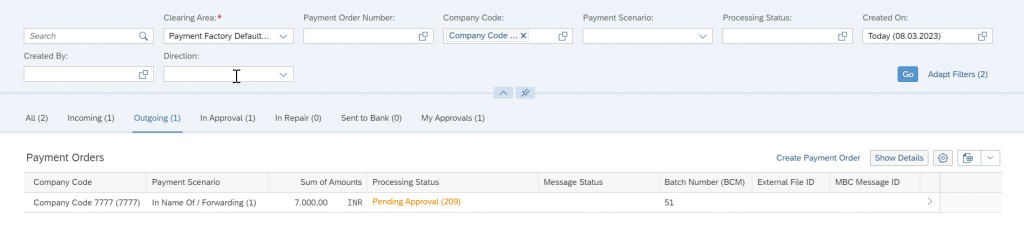

Based on the Incoming order system is processing data and do required data validations in the APM and create the Outgoing order based on that APM batch will the created which will updated in the BNK_MONI (APP, Monitor Payment )

Note:- For Approvals We are using BCM frame work with APM information

For Each outgoing order it has three Segments Originator, Recipient & General Order Data

Originator: – Sending Company code information , Send bank Account Information, Service level Agreements, route, Clearing Agreements & Process flows

Recipient: – Beneficiary Bank Account details, EndtoEndID , Service level Agreements, route, Clearing Agreements & Process flows

Once the APM batch has been Approved with help of BCM Transaction (BNK_APP) or Fiori APP Approve Bank Payments, than an outbound file will be generated which will sent MBC Connector to tenant from their it will be sent to bank.

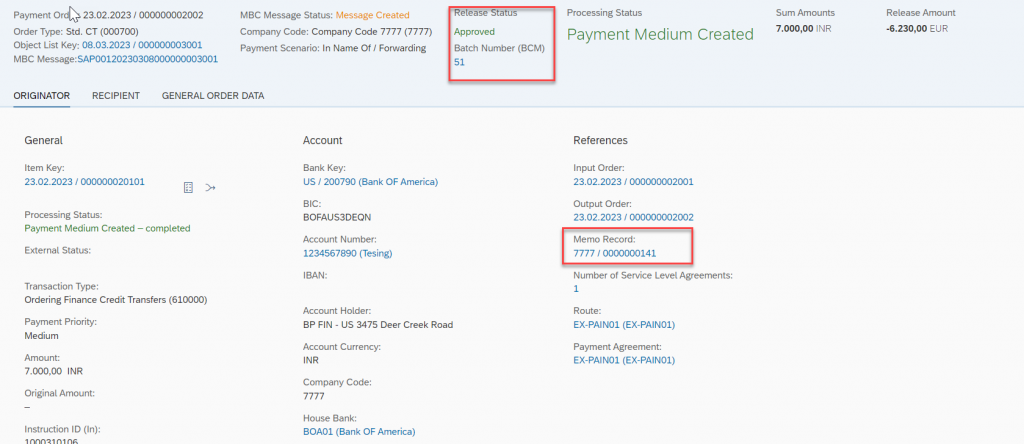

If you Observe in the below screen shot APM batch status is Approved

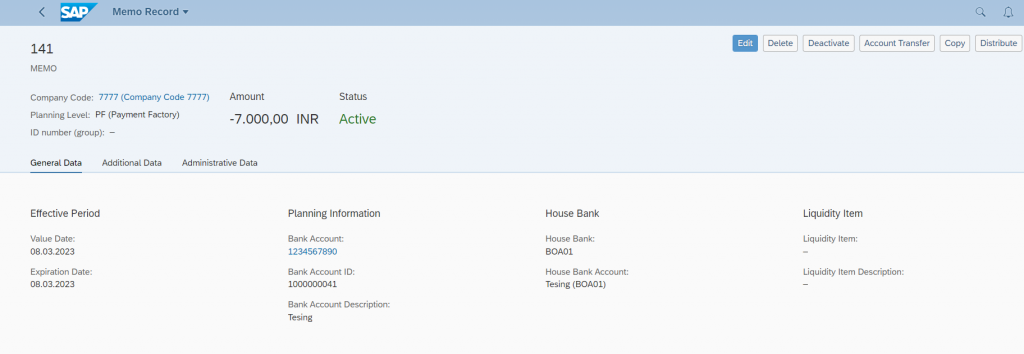

The Memo records will get created based Liquidity Management Application Activation in the Clearing area

It Below mentioned screen shot you can observe that APM Batch has been approved and file been generated which will sent MBC Connector to tenant from their it will be sent to bank.

SAP Menu–> Connector for Multi-Bank Connectivity–> /BSNAGT/MONITOR – Connector Monitor

In the below screen shots, it has been observed that file has set out with the help of MBC Connector to tenant from their it will be sent to bank.

Conclusion:

Below are take away points to be considered for this SAP S/4HANA Advanced Payment Management for scenario payments ‘in name of’ with forwarding.

- Forward payment as is to house bank (no bank account determination – PINO Forwarding)

- No Accounting will be generated from APM for scenario payments ‘in name of’ with forwarding.

- Forward payment case we bring the external system payment file and process in APM and we track them centrally.

- We payment group functionality is available based on the sending company bank key and currency we group the payments at the APM batch level which is available form S/4 HANA 2021.

- We are able to receive the payment files from external system and able to process centrally in APM.

- If we are not Using the MBC than for the file import directly from Physical file name directory with help transaction /PF1/FH_IPM_EXPERT – Execute Import Files.

- If we are not Using the MBC than for the file import from file directory with help of transaction /PF1/FH_IMPORT_DIR – File Directory Import.

- Cash Management will get updated with the help of APM

- In APM Following tables will be used for Master data /PF1/DB_CA, /PF1/DB_ROUTE, /PF1/DB_SLA, and /PF1/DB_EOD_DT etc.,

- In APM Following tables will be used for transaction data /PF1/DB_OLIST, /PF1/DB_ORDER, /PF1/DB_ITEM, /PF1/DB_EXT_STAT, /PF1/DB_ITEM_FI, and /PF1/DB_FH etc.,